Place BID/OFFER

Orders placed are considered limit orders in the marketplace and are visible to other internal participants. It is necessary that the required margin is reserved as soon as the order is created.

Place BID/OFFER

BID and OFFER orders are a special type of limit orders, visible in the market depth by other internal participants in the marketplace. Under certain circumstances, these orders have the ability to allow the trader to avoid/win the spread (Read more).

Bid and offer orders can be used to take, flatten, reduce or increase an exposure.

BID and OFFER orders are visible in the market depth only for amounts from 100 000 units for currencies, 10 Oz for gold, 500 Oz for silver and 1 contract for other instruments. Smaller orders are not visible in the market depth. The execution method remains the same for all size orders..Parameters

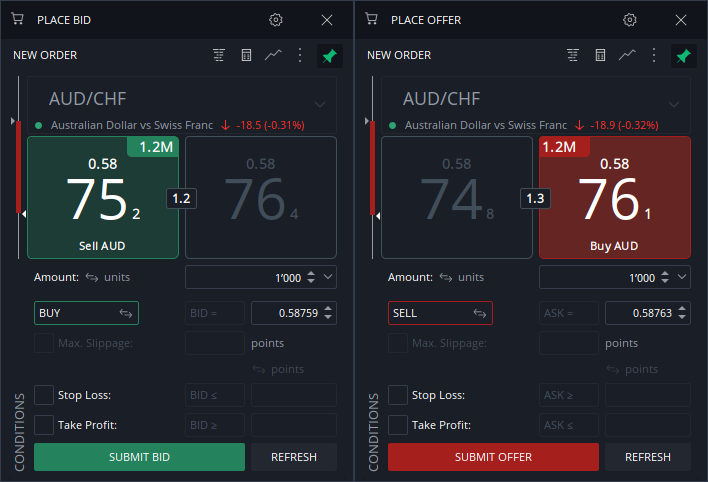

Amount: The amount of the bid, or offer, defined by the trader. The default amount as well as the unit are defined by the preferences and can be modified at order edition.

Price: The limit at which the order will be placed. It shows by default the current best bid market price for a bid order, and the current best ask market price for an offer order.

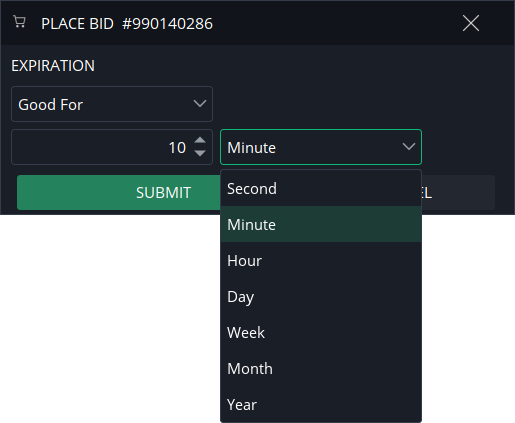

Expiration: The expiration date of the order, defined by the trader either as, good-till-canceled, valid for some time, or valid till a specific date in the future. The GTC option is selected by default.

At expiration time, the order is canceled automatically. Messaging

Processing

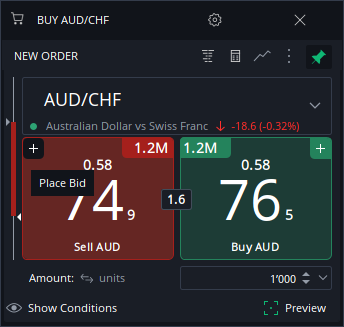

The Place BID and/or place OFFER dialog is available on New Order pane.

The buttons can be hidden in the settings of New order panel.

Execution Process

Bid and offers are placed in the market depth and are visible by internal marketplace participants. As they are limit orders, they cannot suffer negative slippage. If executed, they are executed at limit price, or better. Bids are usually executed fully, or partially, when the market ask level reaches the limit price of the bid order. Offers are usually executed fully, or partially, when the market bid level reaches the limit price of the order. However, in certain circumstances, bids and offers have the ability to allow the trader to avoid/win the spread (Read more).

If a bid is placed with a limit above the current ask market price, it may be immediately executed. If an offer is placed below with a limit below the current bid market rice, it may be immediately executed.Margin Requirements

The required margin for bid and offer orders is calculated and reserved at order creation already. Therefore, the required margin is necessary to place bid and/or offer orders. If there is not enough margin the trader is prevented from placing bid and/or offers. In case bid and/or offers are placed already, and the free trading line shrinks in the meantime, these orders are canceled automatically when the required margin for their maintenance has vanished.

Order Validity/Duration

The time validity of the bid and offers orders can be defined by the trader. Depending on the option selected, the order is canceled automatically once the validity expires.

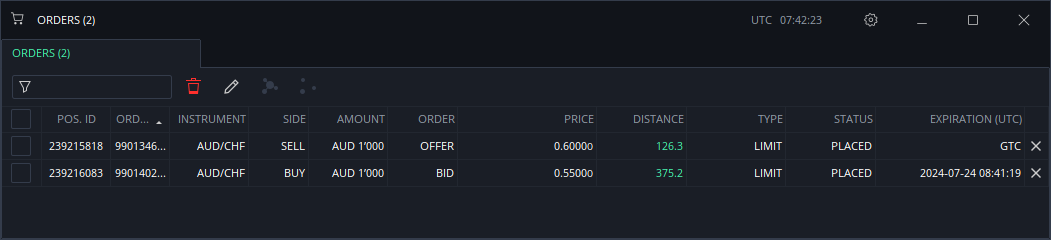

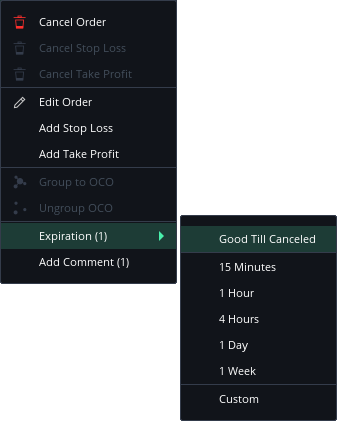

The expiration of the orders can be checked in Expiration column of the Orders table.

Right click the order and select Expiration in menu to adjust it.

GTC

Bid/Offer orders are Good till canceled orders by default. The order will be monitored by our system until:

- it gets triggered

- it gets canceled due to insufficient margin in account

- it gets canceled by user

Good For

Bid/Offer orders can be good for a duration defined by the trader, either in number of:

- seconds

- minutes

- hours

- days

- weeks

- months

- years

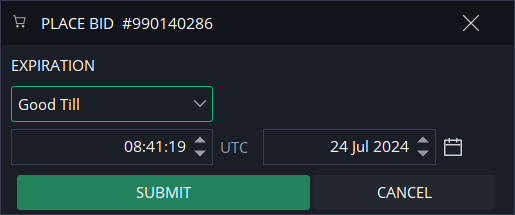

Good Till

Bid/Offer orders can be set as good until a date in the future defined by the trader with a precision of a second.