Equity Management

This article shows how to track your equity and set the equity stop loss level.

Equity Tracking

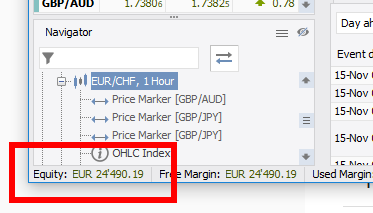

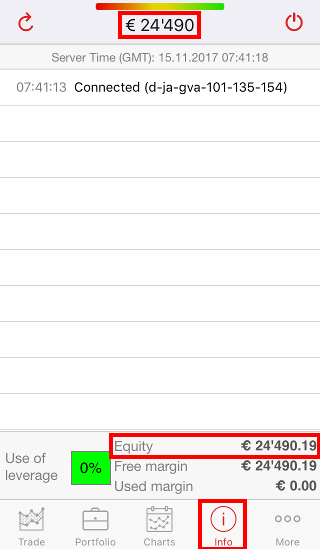

The current equity is displayed in the account base currency on the trading platforms and the trading reports.

Desktop platforms: displayed on the bottom left.

Mobile platforms: a rounded value is displayed on top of the application. To see the exact value, tap Info at the bottom of the application.

Equity Calculation

The equity calculation embeds:

- trading profit and losses (of both open and closed positions)

- commissions (except for the Intraday Statement, where the equity value is displayed before commissions)

- overnight fees (swaps)

- any credit/debit operation on the account (e.g. deposits, withdrawals, dividends, bonuses, maintenance fees etc.)

- mark-to-market conversion impact (trading profit/loss in another currency than the account base currency, conversion rate for the day fixed at settlement).

At platform level, the equity is updated in real time on every received price tick (JForex 3) or in regular intervals (other trading platforms and reports). However, the equity at the server level is updated in true real time in order to secure the timely implementation of margin maintenance requirements.

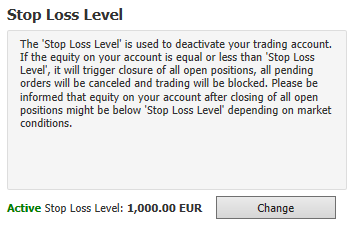

Equity Stop Loss Level

If the equity on your account is equal to or less than the Stop Loss Level, it will trigger the closure of all open positions, all pending orders will be canceled and trading will be blocked.

The equity stop loss level is a trigger value. Exposures are closed at market and the equity on your account after all open positions have been closed might be lower than the indicated trigger value, depending on market conditions at the time the stop loss level is triggered.The Stop Loss Level value is set in the account base currency. By default, it is set to the to minimum equity value necessary to maintain the account active. This is is also the minimum stop loss level.

To set the equity stop loss level for the account:

-

Open the My Account report.

Desktop Platforms: Go to Account > My Account

Mobile Platforms: Go to More > Account > Account settings

-

Locate the Equity Stop Loss section.

-

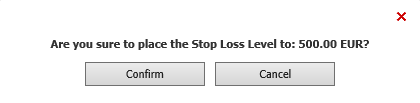

Click on Change, set the value (in the account base currency), then click on Update.

-

A window pops up asking you to confirm the Stop Loss Level. Click on Confirm.

-

The equity Stop Loss Level is now set.

Changes are recorded in the Account Log (Account > Account Log).

If the account is blocked because of the stop loss level, you can reactivate the account by submitting a new equity stop loss level that is below the account equity.

The maximum allowed stop loss value is your equity at the time the instruction is sent. If the level is set to the maximum value or in close proximity, it may trigger the closure of existing exposures and block the account immediately, if the equity is equal to or below the level once the instructions are received.Account base currency

Trading accounts are single currency accounts. The currency in which an account is denominated is defined as the base currency of the account.

A cash flow or trading profits/losses involving another currency than the base currency must therefore be converted into the account base currency.

Trading profits and losses

The conversion rate (market rate adjusted by a mark up) of the trading profit and loss, where the profit or the loss is in another currency than the base currency, is marked-to-market until the next settlement (21:00/22:00 GMT summer/winter time). At this time,profit and losses are settled and the conversion rate is fixed.

This means that with the market rate, the conversion rate changes throughout the ongoing trading day and is fixed at settlement, using settlement prices. Due to this process, even with closed (but unsettled) exposures, your equity might fluctuate (slightly) until settlement.

For exposures that stay open overnight, trading profits/losses are calculated for each trading day and converted using conversion rate of that specific trading day.

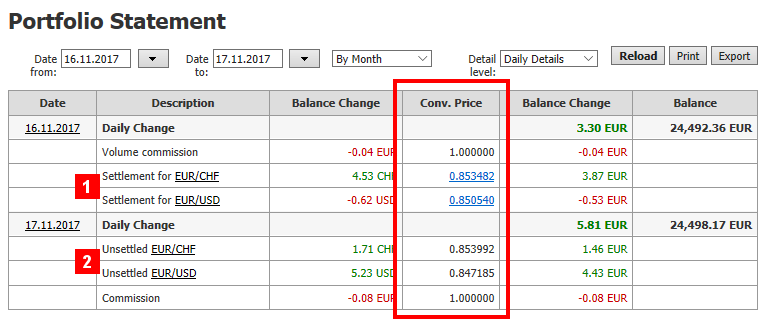

You can see the conversion rate in the Portfolio Statement report. For previous trading days, the conversion rate is fixed and all trades are marked as Settlement for... (1). For the current trading day, the conversion rate may still change and trades are marked as Unsettled (2).

Example 1:

- Your account base currency is EUR. During the day you traded EUR/USD, accordingly all profit and losses are denoted in USD.

- You closed all positions and made a profit of 100 USD.

- The profit is marked-to market, meaning it is being converted into EUR at the current EUR/USD rate (adjusted by the mark up).

- During the ongoing trading day, the corresponding EUR value for your 100 USD profit changes with the EUR/USD rate and your equity fluctuates (slightly).

- At settlement, the conversion rate is fixed. The corresponding EUR value for your 100 USD profit is therefore fixed and your equity stops fluctuating.

Example 2:

- Your account base currency is EUR. During the day you trade EUR/USD, but this time you keep your position open.

- The trading profit/loss is being converted into EUR at the current EUR/USD rate (adjusted by the mark up).

- At the end of the trading day the profit of your position is 100 USD and converted into EUR using the now fixed conversion rate for that trading day.

- During the next trading day, the positions gains another 50 USD and you close it

- Until settlement, the profit is marked-to-market and at settlement, the conversion rate is fixed.

- The total profit of the position is 150 USD, but split between two trading days. 100 USD are converted into the account base currency using the conversion rate from day 1, 50 USD are converted using the conversion rate from day 2.

Other cash flows

Cash flows in another currency than the base currency are converted at the market rate at the time of the booking plus a variable commission (refer to your broker for more details).