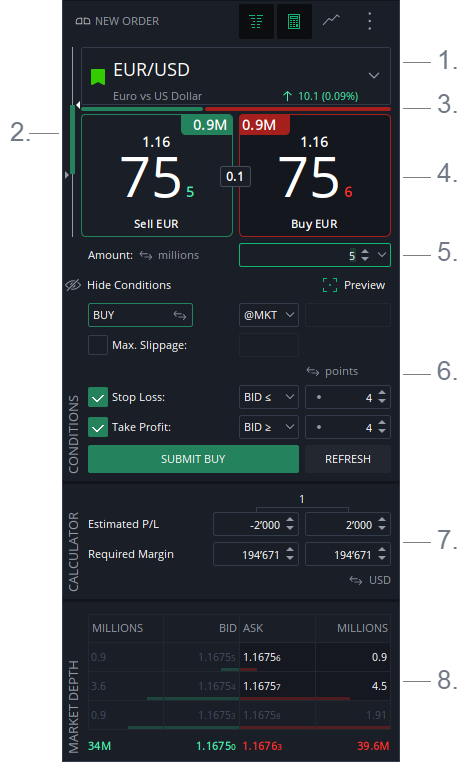

New Order

This panel is designed for placing market and conditional orders.

- Instrument Selector

- Daily range

- Sentiment index

- Price tickers

- Amount

- Conditions

- Calculator

- Market Depth

Appearance

- Located on the left side of the main frame

- A dialog window (can be opened by double-clicking any row in the Instruments table or by pressing F9)

- Chart trading dialog (can be opened from the context menu)

1. Instrument selector

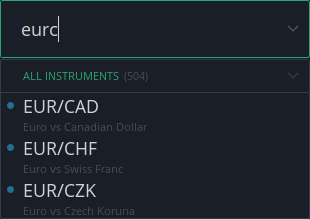

Left-click to enable edit mode and search for an instrument.

You can search for an instrument by:

- Symbol

- Description

- Group

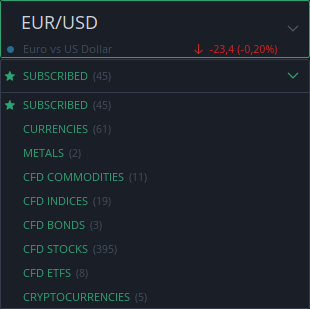

Click the arrow to open the list.

Since the number of instruments is very large, an additional nested list is available, which groups instruments by type.

Hover the mouse over an instrument to view information about its trading breaks:

- The inner circle represents AM hours, the outer circle represents PM hours.

- The countdown shows the time left until the next market break (if the market is open) or until market opening (if the market is closed).

- Squares indicate whether the market is open on weekends.

- A small triangle shows the current time.

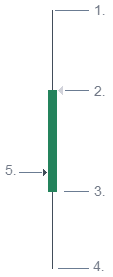

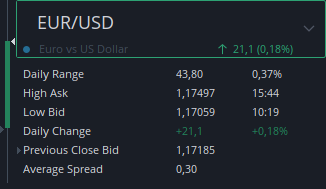

2. Day's range

The candlestick displayed on the left side shows the daily change and the high/low range.

- High ASK

- Current BID (shown as a triangle)

- Open BID of the current day

- Low BID

- Triangle on the left – previous day’s closing BID

All displayed data use the time zone set under PREFERENCES → GENERAL.Hover the mouse to view additional information:

- Daily range: the difference between High ASK and Low BID, shown in points and as a % of price

- High ASK price and time

- Low BID price and time

- Daily change: the difference between the current BID and the previous day’s closing BID

- Average spread

Average spread

The AVERAGE SPREAD is the historical BID/ASK spread, calculated from the last week’s data.

One hour before and one hour after settlement are excluded, as spreads are usually wider due to low liquidity.

The value is updated once a week, at the start of each Monday (00:00 EET).

The average spread can be used as a default trading value when setting distances, as an alternative to specifying distance in points. Trading default settings can be configured under PREFERENCES.

The Day’s range can be hidden in the settings of the NEW ORDER panel.

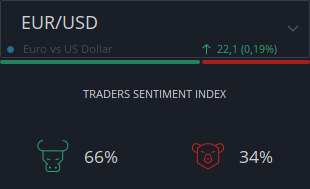

3. Sentiment index

Proprietary index showing the ratio of liquidity consumers to liquidity providers.

Hover the mouse to view the numbers.

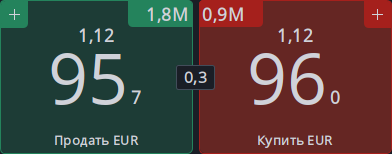

4. Price tickers

Price Tickers show the current BEST BID and BEST OFFER.

Right-click to change the settings.

The number in between represents the current market spread, which is the difference between the BEST BID and BEST ASK.

- Clicking the BEST BID price ticker (on the left) sends a market SELL order for the amount set below.

- Clicking the BEST ASK price ticker (on the right) sends a market BUY order for the amount set below.

To place a BID or OFFER, a special dialog must be used. This dialog opens by clicking the buttons in the inner top-left and top-right corners of the PRICE TICKERS.

The conditions set in the CONDITIONS panel are not applied when sending a market order by clicking the PRICE TICKERS.It is possible to automatically send a Stop Loss and Take Profit order for positions opened at market using the Price Tickers.

The distance for both is set in Preferences → Trading → Default Trading Values.

To enable this feature, users must enable "Apply default Stop Loss” and “Apply default Take Profit” for Market type orders under Preferences → Trading → Trading Settings.5. Amount

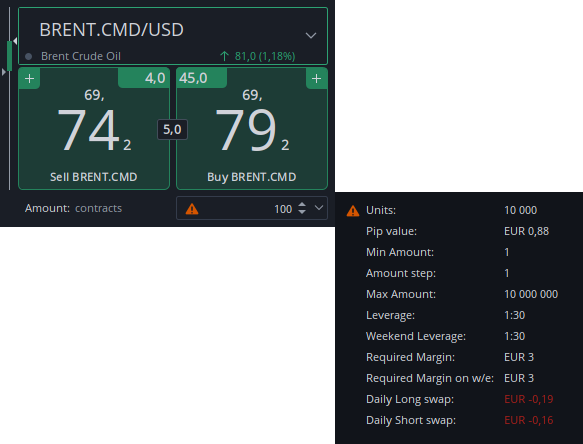

The value set in this field is used when:

- Clicking the PRICE TICKERS to send a market order

- Sending a conditional order by pressing the SUBMIT button

Hover over the amount spinner to display trading information related to the selected amount.

If a yellow triangle appears on the spinner, the CFD instrument has an amount multiplier, meaning each contract contains multiple units. The amount in units is displayed in the tooltip.Example: One contract of BRENT.CMD contains 100 units (barrels). The price is quoted per unit, so the multiplier affects the resulting profit or loss.

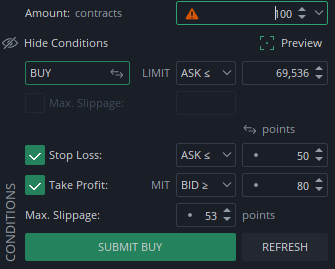

6. Conditions

This section is designed for additional settings of market and pending orders.

Click SHOW CONDITIONS to display the CONDITIONS section.

The conditions set in the CONDITIONS panel are not applied when sending a market order by clicking the PRICE TICKERS.Preview

Enable PREVIEW to display the order line(s) on charts.

Price format

The price of Stop Loss and Take Profit orders can be displayed as:

- Points (a dot is shown in the spinner)

- Price

- % of price (a % is shown in the spinner)

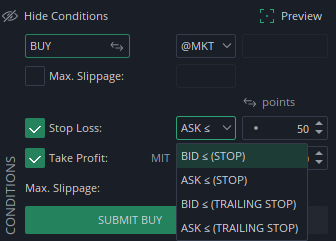

Opposite trigger

STOP and STOP LOSS orders can use the opposite trigger side to prevent accidental execution on wide spreads when liquidity is low.

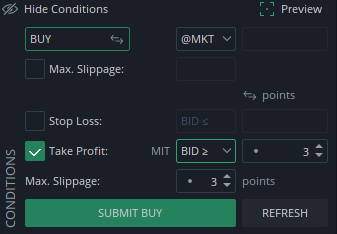

A setting in PREFERENCES → TRADING SETTINGS can automatically set the opposite trigger side. It is disabled by default.Take Profit as MIT

To increase the chance of filling a Take Profit order, it can be set as a MARKET IF TOUCHED (MIT) order.

- This order is executed as a market order when the Take Profit price is triggered.

- MAX SLIPPAGE must be set to limit the execution price.

- If the order cannot be filled within the price range, it will remain active at the new limit price.

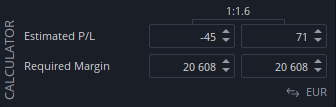

A setting in PREFERENCES → TRADING SETTINGS can automatically set Take Profit orders as MIT. It is disabled by default.7. Calculator

The panel displays ESTIMATED LOSS and ESTIMATED PROFIT only if:

- Values for STOP LOSS and TAKE PROFIT are set in the CONDITIONS panel, or

- STOP LOSS or TAKE PROFIT is enabled for MARKET orders in PREFERENCES.

In these cases, the values are shown even if the CONDITIONS panel is closed.

The RISK REWARD ratio is displayed if both STOP LOSS and TAKE PROFIT are enabled.

Required regular and weekend margins fully depend on the AMOUNT set and the LEVERAGE of the selected instrument.

Changing values in the CALCULATOR affects the AMOUNT value only.8. Market depth

The Market Depth table displays available liquidity. Up to 10 price levels can be shown on each side — BID and ASK. Right-click to choose how many rows to display.

When hovering over the Best BID or Best ASK buttons, certain cells in the table are highlighted. These indicate the depth required to execute the amount specified in the Amount field.

Note that this depth is indicative only and may differ from the actual execution price due to constantly changing market liquidity and possible price slippage.TOTALS, which are shown at the bottom of the table, display the sum of BID and ASK amounts, along with the average price across all 10 levels.