Portfolio Statement

The portfolio statement report integrates information from equity and trade management, providing interactive reporting and data management facilities on a daily historical basis. The portfolio statement is accessible under the platform tab Portfolio > Portfolio Statement

The portfolio statement information can be printed, and/or exported.

A day is defined as the period between two settlement procedures. 21:00:00 GMT in Switzerland summer time, and 22:00:00 GMT in Switzerland winter time.The parameters to display the data in the portfolio statement are:

-

The date range from – to OR by choosing a month in the drop down menu

-

The Detail level There are 3 detail levels (Summary, Order and Trade), all described below:

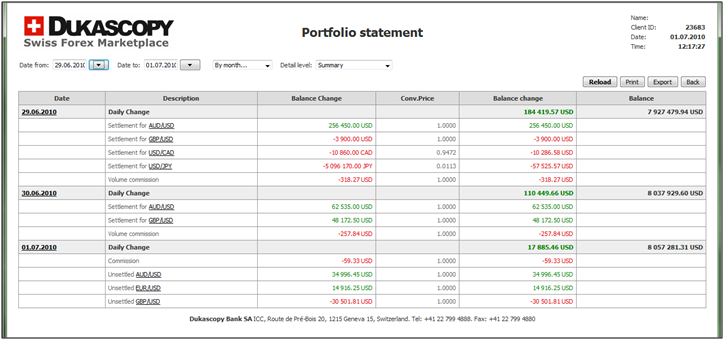

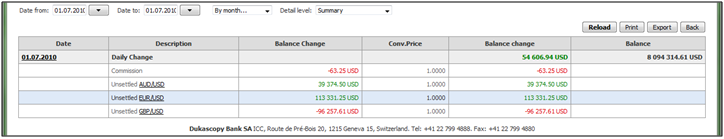

Summary Detail

Traders users can see the consolidated account activity on a daily basis. An historical range can be selected by a date range, or by month. The account information regarding the current date must be refreshed in order to have the profit & loss, exposures and trades information refreshed. Especially upon reload, trades are mark-to-market with the current market price. The information provided in the portfolio statement is: the trading profit and loss per instrument, the global commission accounting and the cash flow activity. These figures added for balance and equity daily changes. Since the activity of the current day is floating until settlement time, the trading profit and loss in every instrument is labelled as "unsettled" while historical daily activity in every instrument is labelled as "settlement for". The trading profit and loss is shown in the second currency of the currency pair considered in the column "Balance Change", then translated in the portfolio base currency.

From the summary level, the order detail on an instrument where a trading activity has been conducted is accessed by clicking on the instrument

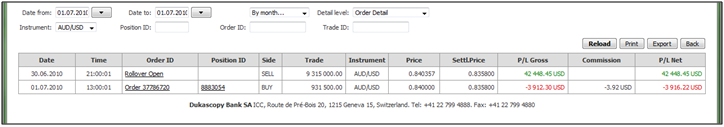

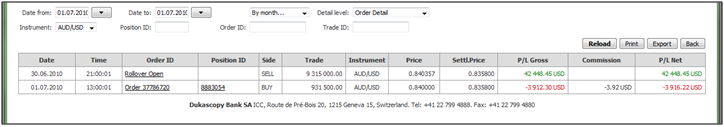

Order detail level on AUD/USD for the day selected

Order Detail

The order detail level provides information about the trading activity and exposure management per order for the selected period time. The swap process is shown in the order detail. All orders and swap legs are evaluated either with the settlement price if history is selected or with the current market price if the current day is selected. The parameters of the report can be changed at the order level. Swap legs and orders can be selected directly to retrieve their trade information. A specific position, order and trade can be tracked with their respective identification numbers.

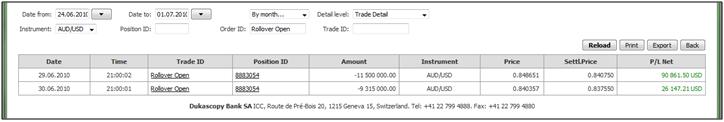

Trade level report obtained by selecting the Rollover Open (swap far leg)

Order detail level obtained by selecting the Position ID.

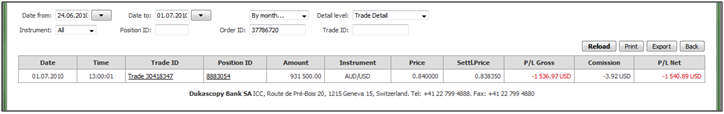

Trade level obtained by selecting the Order ID

Trade Detail

The smallest increment or component of an exposure is the trade. An order can be executed into multiple trades with multiple and different counterparties.

General specifications

Portfolio Statement is the main financial report which contains all transactions related to a particular trading account, including: settled and unsettled trading profits/losses per instrument, charged commissions and fees, overnight rollovers, currency exchanges, deposits/withdrawals, accrued adjustments and other account balance transactions. All other trading financial reports (such as Position Report, Consolidated Report etc.) are based on information from the Portfolio Statement. In case of any discrepancies the Portfolio Statement shall be taken as reference. A trading day in Portfolio Statement Summary is defined as the period between two trading settlements (21:00:00 GMT summer time, and 22:00:00 GMT winter time). Transaction timestamp in Portfolio Statement represents the time when a transaction was recorded in the database and is considered as reference for financial calculations. Due to the fact that the execution process is independent from the recording process it is possible in some cases that the timestamp of a trade does not fully match its execution time.