Close

The close order is a market order issued by the close command on one or several positions. Depending on the side of the position, the market order to close can be either a buy or sell order. It is deemed unconditional for the same rationales as for the market unconditional order, that is, the reference for execution is the market price at the time the close order is created and sent, and the Max.Slippage control is disabled by the trader. Again, assuming that the preferences are not set for applying the default slippage value to market orders, the close order embeds a hidden slippage value whose value depends on the instrument. It is also deemed unconditional because the close order will apply to the full position amount of the position(s) selected. The order at this point may be either, executed in full, executed partially, or rejected.

The close order can be used to remove, reduce or increase an exposure.

Parameters

Amount: The amount of the close order is the amount of the position(s) selected and cannot be modified by the trader.

Slippage: The Max.Slippage control is disabled, and assuming that the preferences default slippage value is not applied to all market orders, the hidden Max.Slippage value is set.

Messaging

The action of closing a position or group of positions and according consequences are recorded accordingly in the messages log, activity log, trade log and other reporting sections if some execution occur; below is an example of a closing order issued from the position #8863351.

13:43:34 Order FILLED at 1.35075 CHF (#37556381 BUY 0.5 mil. EUR/CHF @ MKT) - Position #8863351

Closing order sent: BUY 0.5 mil. EUR/CHF @ MKTProcessing

The close command is processed by clicking on the cross at the end of the row in the Positions pane, right-clicking on the position(s) selected in the Positions pane, or the instrument position in the Position summary, selecting the option "Close position", and releasing the mouse.

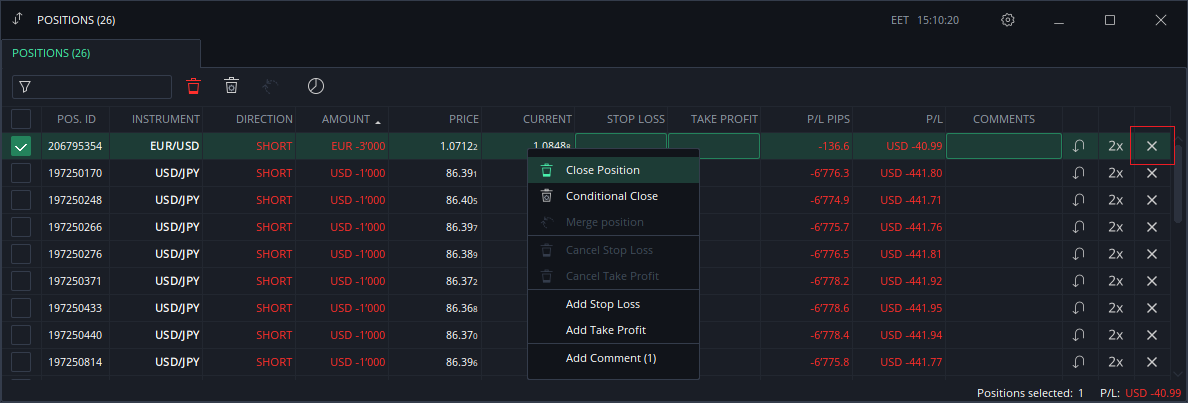

Assuming the one-click trading mode is turned on, the release of the mouse button once the option "Close position" is selected will sent a close order without any further warning. Close position command from the Positions pane for one single position.

Close position command from the Positions pane for one single position.

Close position command from the Position Summary pane for a single instrument position.

Close position command from the Position Summary pane for a single instrument position.

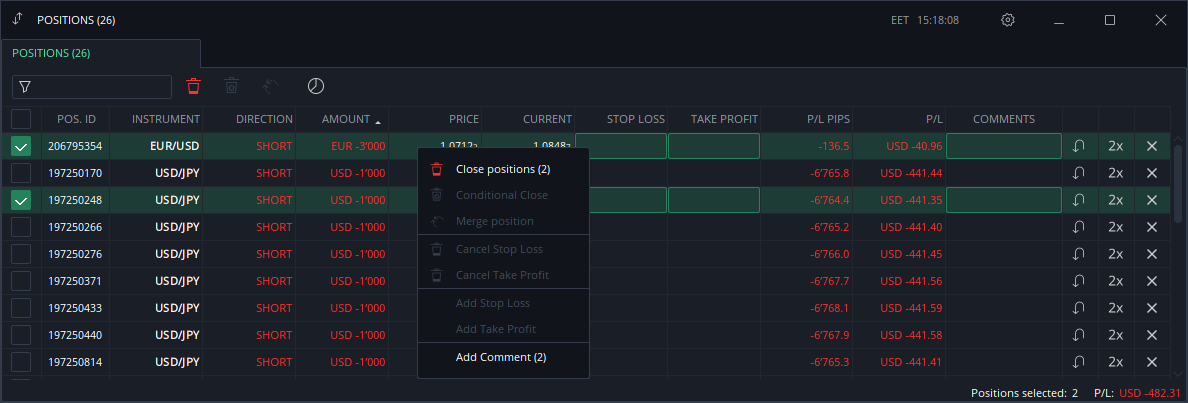

The Close position command executed from the position summary pane will close all exposure components at the market without any consideration to the side of individual exposure components. If the exposure is hedged, that is, the position summary is composed from long and short positions, the Close position will close them independently by closing short positions with buy market orders, and long positions with sell market orders. Traders are encouraged to merge any hedged position before closing position from the position summary pane. This way will save the spread cost and commissions, since only the net exposure in the selected instruments will require a market transaction to be closed, and to one side of the market only. A perfectly hedged position, that is, a flat exposure, will be cleared by the merge operation. Close position command from the Positions pane for selected positions. In this example, both positions #206795354 and #197250248 will be closed by a single close command. Rows can be selected by holding Shift or Ctrl key, when clicking.

Close position command from the Positions pane for selected positions. In this example, both positions #206795354 and #197250248 will be closed by a single close command. Rows can be selected by holding Shift or Ctrl key, when clicking.

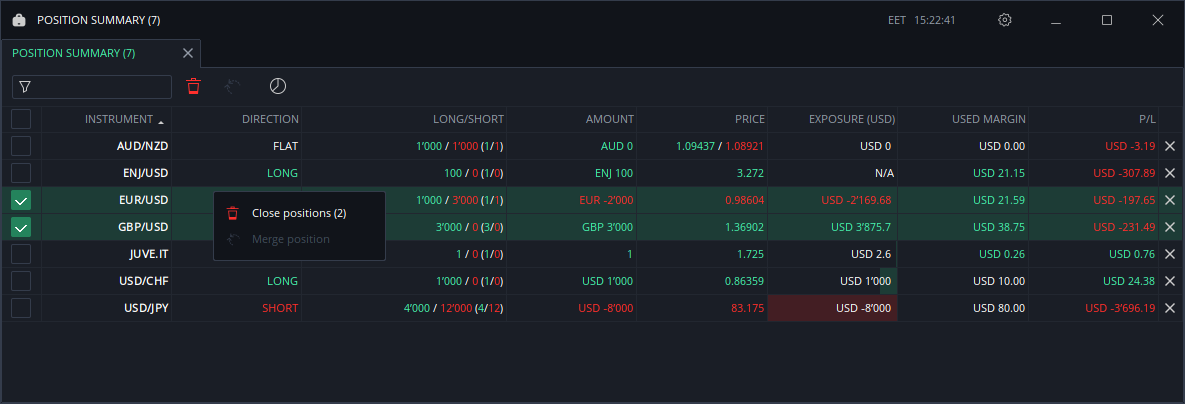

Close position command from the Position Summary pane for selected instruments positions. In this example, all individual positions of the exposure in GBP/USD and EUR/USD will be closed by a single command.

Close position command from the Position Summary pane for selected instruments positions. In this example, all individual positions of the exposure in GBP/USD and EUR/USD will be closed by a single command.

The Close position command executed from the position summary pane will close all exposure components at the market without any consideration to the side of individual exposure components. If the exposure is hedged, that is, the position summary is composed from long and short positions, the Close position will close them independently by closing short positions with buy market orders, and long positions with sell market orders. Traders are encouraged to merge any hedged position before closing position from the position summary pane. This way will save the spread cost and commissions eventually, since only the net exposure in the selected instruments will require a market transaction to be closed, and to one side of the market only.Execution Process

The unconditional close order is sent to the marketplace server. The order at this point may be executed in full, executed partially, or rejected. The reason for rejection would be that the price at this time was no longer satisfying the embedded conditions when the market order was sent. Remember that unconditional does not mean that the close order will be executed at any price condition. Indeed, if it was the case, orders would run the risk of being executed even if the market would be far away from the market the trader saw or traded when he sent the order. Again, there is a delay between the time the order is sent, and the time the order reaches the marketplace. This delay is understood to be the shortest possible one, but cannot be zero, and the market has no memory of the situation when the order was sent. As a result, the system embeds a maximum value of negative slippage even on unconditional market orders, where the slippage control is disabled on the trader side. This value is fixed and always the same for every client and every market order when the slippage control is disabled on the client application side. This is obviously to prevent executions at prices either far away from the price the trader acted on, or at prices away of the general market level. To avoid risk of multiple executions of a unique order amount, each order is routed to the marketplace one at once. The order cannot be treated simultaneously by several liquidity sources, or counterparties. The trader must follow closely the closing order process, especially when large positions are involved. It is likely that large positions will be closed after several partial executions, and it is wise for the trader to monitor this process.

Margin Requirements

The margin requirements for an unconditional close order are calculated when the order is sent for execution. Usually, the closure of a open position has often the consequence of reducing or removing the global exposure of an account, meaning the margin requirements are satisfied in such cases since reducing the net exposure increases the available margin, i.e., the free trading line. However, hedged exposures may create situations where the closure of some position results in an actual increase of the net global exposure of an account. In such cases, the closure of a position is prohibited if the corresponding increase of the net exposure is not covered by the margin. The part of the close order being covered by the actual margin will be sent for execution, and the remaining part of the order rejected. In order to close at this point, traders should merge their hedged positions, entirely or in part, and close the remaining net or new hedged exposure.