Market Order with Max.Slippage

Compared with unconditional orders, the conditional orders are orders that are either constrained regarding the conditions of their immediate execution, or are defined to be executed later than when they are created and submitted, usually at market prices levels not prevailing at the time the order is created. Such constraints and conditions are basically under the form of limits on execution price and/or triggers on market price. This section explores in depth each conditional order.

Conditional does not mean that such orders may not be executed immediately. Indeed, the constraints and/or conditions for either limit or trigger may be true, or realized already at the time the order(s) is(are) sent.

By contrast to the unconditional market order, where the Max.Slippage condition is hidden for the rationales described before, the conditional market order has its control for Max.Slippage set by the trader. The Max.Slippage condition is therefore either being defined as the default value set in the preferences, and the option "Apply default Max. Slippage value to Market orders" enabled, or set at the order trading pane by the trader. Any Max.Slippage value sets in fact a limit for the market order, where the limit is the price on which the trader clicks, or the market price at the time the order is sent.

The conditional market order is Immediate or Cancel. In case of no execution, the order is immediately canceled on rejection. In case of partial execution, the order on the remaining amount which has not been executed is immediately canceled on rejection.

The conditional market order can be used to take, remove, decrease or increase an exposure.

Parameters

Amount: The amount of the order is defined by the trader.

Max.Slippage: The slippage control by the trader is enabled and its value is defined by the trader. If the trader does not define any value, a system default value will be automatically applied by the system whose value depends on the instrument.

Messaging

The action of sending a conditional market order and according consequences are recorded in the messages log, activity log, trade log and other reporting sections if appropriate. Below are three examples of a conditional market order executed as it is recorded in the messages log. The first example shows the message log for conditional market order sent with a maximum slippage of 5 pips, the second one the rejection of a conditional market order sent with a maximum slippage condition of zero, and the third one shows a conditional market order sent with a maximum slippage condition of zero and executed. The indication that the market order is conditional is the mention @ MKT MAX SLIPPAGE 0.0005, or @ MKT MAX SLIPPAGE 0.0000. Please note that for messaging dispatching purposes, the unit of the slippage condition is in conventional decimals which allows for direct comparison with the execution price. Clients should always check the messaging while sending an order. The proper sequence is made of three lines of confirmation.

1.The creation of the order (Sending order)

2.The acceptance of the order by the server (Order sent)

3.The confirmation of either full or partial execution (FILLED) or rejection of the order (REJECTED). The disruption of the messaging sequence signals a problem occurring in either the order submission or execution process. The messages log dispatches the most recent information up.

09:36:49 Order FILLED at 1.55374 CAD (#37604866 BUY 0.5 mil. GBP/CAD @ MKT MAX SLIPPAGE 0.0005) - Position #8874726

09:36:49 Order sent: BUY 0.5 mil. GBP/CAD @ MKT MAX SLIPPAGE 0.0005

09:36:49 Sending order: BUY 0.5 mil. GBP/CAD @ MKT MAX SLIPPAGE 0.0005 09:37:09 Order 37604879 was REJECTED: Rejected by counterparty

09:37:09 Order sent: BUY 0.5 mil. GBP/CAD @ MKT MAX SLIPPAGE 0.0000

09:37:09 Sending order: BUY 0.5 mil. GBP/CAD @ MKT MAX SLIPPAGE 0.0000 09:37:21 Order FILLED at 1.5538 CAD (#37604884 BUY 0.5 mil. GBP/CAD @ MKT MAX SLIPPAGE 0.0000) - Position #8874732

09:37:20 Order sent: BUY 0.5 mil. GBP/CAD @ MKT MAX SLIPPAGE 0.0000

09:37:20 Sending order: BUY 0.5 mil. GBP/CAD @ MKT MAX SLIPPAGE 0.0000 User interface

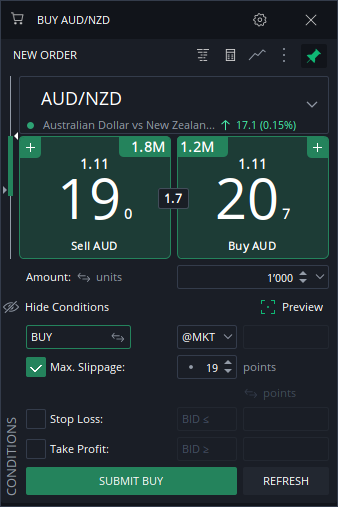

Max.Slippage enabled for Market order in New order panel:

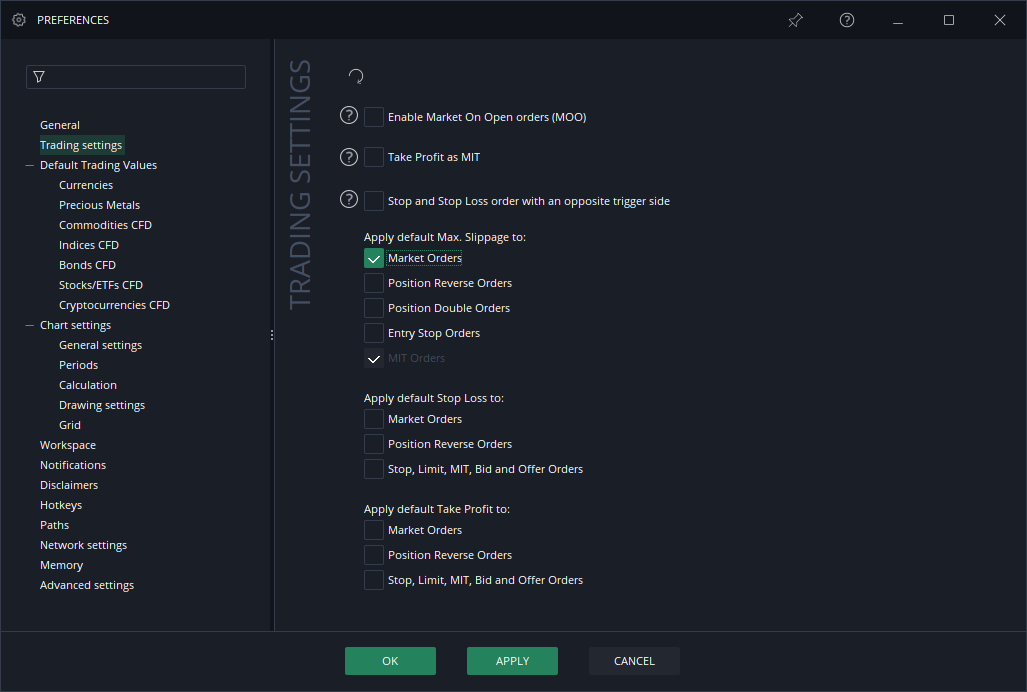

Option Apply default Slippage to all Marker Orders enabled:

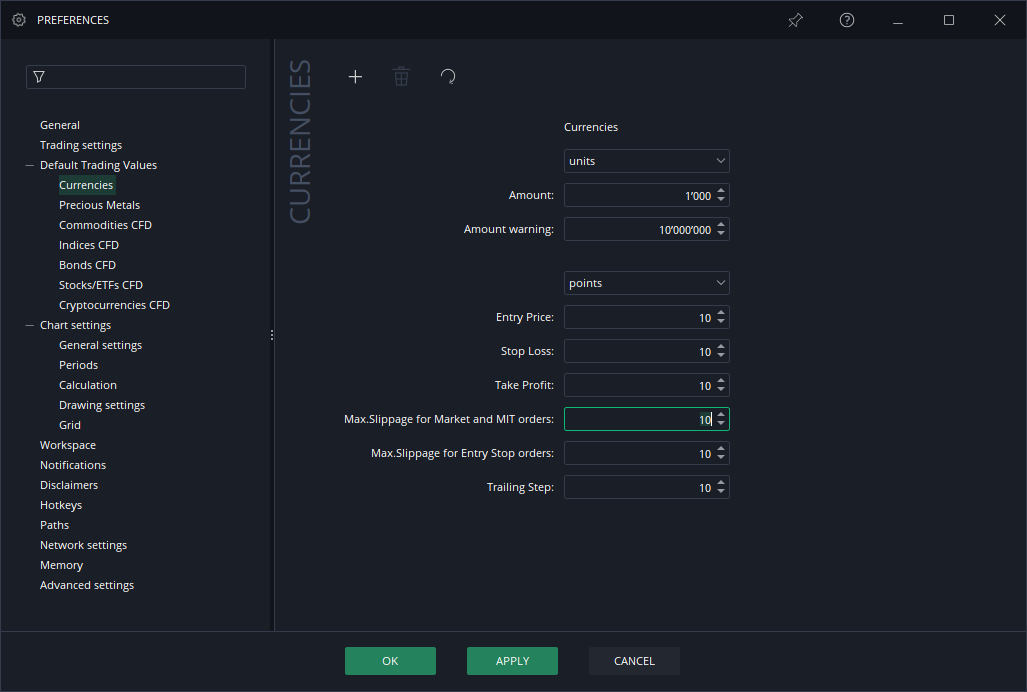

Default value for all currency pairs:

Assuming the One-click trading mode is turned on, a single click on any trading quarrel or a push of the submit button will sent an order without any further warning.

Execution Process

The unconditional market order is sent to the marketplace server for execution. The order at this point may be either, executed in full, executed partially, or rejected. The reason for rejection would be that the price at this time was no longer satisfying the embedded conditions when the market order was sent. If the attempt at the best price fails, the attempt of getting another price within the Max.Slippage condition set by the trader will be processed within the same sequence. By defining the slippage condition, the trader decides to relax (Max.Slippage value above zero) or not (Max.Slippage value of zero) the price condition of its execution.

To avoid risk of multiple executions of a unique order amount, each order is routed to the marketplace one at once. The order cannot be treated simultaneously by several liquidity sources, or counterparties. It is therefore possible that a market order suffers rejection and therefore be canceled while at the same time, another liquidity source comes with a price that would satisfy the conditions of executions for the original order. This is the reason why traders are encouraged to thoroughly monitor the messages log and the market prices simultaneously to be able to send another market order should the first attempt be rejected and canceled, and the market price returning to acceptable levels for the trader.

The Max.Slippage value may be defined for the purpose of increasing the probability of execution at the expense of the execution price, but also to increase the probability of executing a large transaction at once. Basically increasing the slippage also means that the market depth will be tested for execution. Although decent, the liquidity at the spread may not be sufficient to grant the execution of a large order in one attempt, the trader may therefore use the Max.Slippage value for the order to seek further liquidity beyond the market spread.

When defining a Max.Slippage value when they control for slippage, the traders must bear in mind that there is no ideal Max.Slippage value because it depends on future market conditions. Max.Slippage control always requires some assessment over the future volatility of the market. Traders should control their slippage according to their price/probability of execution sensitivity and preferences. Price sensitive traders should use zero, or small slippage values. Traders who focus on the probability of the execution should set larger slippage values. However, there is no absolute rule, and selecting the appropriate slippage value ex-ante is a challenging task.Margin requirements

The margin requirements for a conditional market order are calculated when the order is sent for execution. Should the margin be not enough to cover the full execution of the market order, the part of the order not covered by the margin will be rejected and only the amount covered by the margin will be sent for execution.

Whatever the amount of the order is, the check for margin requirements will always allow for the maximum amount possible to execute with a given margin. It means that any execution will be allowed until the use of leverage reaches 100 %. In a situation where the trader input, mistakenly or willingly, an order amount larger than the maximum order amount covered by the margin, the part of the order that is covered by the full available margin will be sent for execution, and the account will be fully exposed should such part of the original order not suffer rejection.