Trailing Stop

This article explains how the trailing stop works.

A trailing stop, if applied, changes the trigger price of entry stop and stop loss orders when the price moves in a certain direction and beyond a pre-defined threshold.

If the price does not move in the direction that is required by the trailing stop or the price does not move beyond the threshold, the trigger price is not changed.

The trailing stop is server-based. This means that it is also active when the trading platform is switched off.Threshold

In order to understand how trailing stops work, it is important to know how the base price and trailing steps define the threshold.

Base price

It is not possible to manually set the base price (as in typing in a specific value). Instead the system defines the base price based on these rules:

-

At the moment the trailing stop is added or ANYTIME the trader edits the trailing order, the current market price is defined as the base price.

-

An exception applies for trailing stop loss orders of pending entry stop orders. The market price at the time the entry order is triggered becomes the base price.

-

Once the trailing stop has shifted the trigger price of an order, the price tick that triggered the shift automatically becomes the new base price.

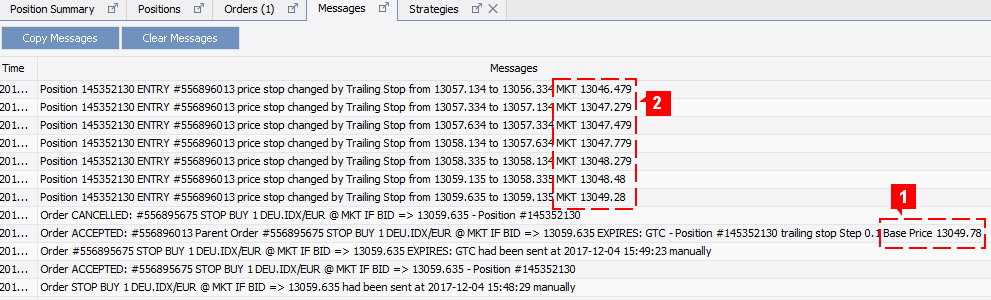

Examples of platform messages showing the initial base price (1) and how the base price changes (2) as the trailing stop shifts the order trigger price:

Trailing Step

The trailing step defines the distance at which the threshold is set from the base price.

It is set by the trader and the minimum value is 10 pips.

Threshold

A simplified example to illustrate how the threshold is calculated:

- Base price: 1.2000

- Trailing Step: 15 pips

- Threshold: 1.2015 or 1.1985 (depends on order type and direction)

If the price moves beyond the threshold (and in the right direction), the trailing stop changes the trigger price.

Price Shift

The size of the price shift is defined by the distance between the base price and the first price tick beyond the threshold.

This means that the size of the price shift is variable, but it cannot be less than the trailing steps value.

If the trailing steps value is e.g. 10 pips, the price adjustment will be at least 10 pips but could also be bigger.

A simplified example:

- Base price: 1.2000

- Trailing Step: 15 pips

- Threshold: 1.2015

- First price tick beyond threshold: 1.2021

- Price shift: 21 pips (1.2021 – 1.2000)

Stop Loss

A trailing stop can be added to a stop loss order by:

- editing an existing stop loss order

- adding a stop loss order to an existing position or pending entry stop order

It is not possible to add a trailing stop when setting the trigger price of a stop loss for a new entry order.

Conditions

If these conditions are met, the trailing stop shifts the trigger price of the stop loss order up (long position) or down (short position):

- market price moves in your favor (for long positions that is up and for short position down)

- market price moves beyond the threshold.

Example

This example refers to a stop loss order for a long position.

- Buy EUR/USD at 1.1150 and add a SL at 1.1130 with trailing steps 10 pips

- Current Market BID is 1.1149 and set as base price

- Market BID reaches 1.1159 (= 10 pips from base price)

- SL is moved to 1.1140 and 1.1159 becomes the new base price

- Market jumps to 1.1179 (= 20 pips from base price)

- SL moved to 1.1160 and 1.1179 is the new base price

Entry Stop

A trailing stop can be added to an entry stop order by:

- editing an existing entry stop order

Conditions

If these conditions are met, the trailing stop shifts the trigger price of the entry stop order down (for buy orders) or up (for sell orders):

- market price moves lower (for buy orders) or higher (for sell orders)

- market price moves beyond the threshold.

Example

This example refers to a buy entry stop order.

- You want to buy EUR/USD if ASK is equal or bigger than 1.1150 and add a trailing stop with trailing steps 10 pips

- Current market ASK is 1.1130 which is set at the base price

- Market ASK reaches 1.1120 (=10 pips from base price)

- Entry stop order is moved to 1.1140 and 1.1120 is the new base price

- Market ASK drops to 1.1100 (=20 pips from base price)

- Entry stop order is moved to 1.1120 and 1.1100 is the new base price