Use of Leverage

The use of leverage is the relative use of the total authorized free trading line and is a function of the Equity and the used margin. It is displayed at the bottom of the platform main window, as a percentage of the total margin and rounded down to the nearest integer.

As exposure increases, the free margin shrinks and the use of leverage increases. It is also depends of profit and loss since profit and loss drives equity which in turns determines the total free margin. All else being equal, profits increase equity. An increasing equity increases the total margin available for trading. An increasing total margin decreases the use of leverage, assuming the net exposure remains the same. The reverse is true for losses.

Formulas:

Used margin = Equity - Free Margin

Leverage = Total Exposure / (Use of Leverage x Equity)

Use of Leverage = (Used Margin / Equity)*100

The clients must always keep in mind that the use of leverage magnifies losses as well as profits. Equity can easily and quickly vanish in situations where the market prices exhibit strong volatility, potentially creating an adverse environment for the highly leveraged participant.

We reserve the right to take any action judged necessary to reduce, or eliminate the shortfall risk associated with portfolios having Free Margin null, even in case it would not be in accordance, in whole or in part, with the procedures described in this section, or elsewhere in the manual.Maximum Authorized Leverage

The maximum authorized leverage is the leverage factor attributed to the account. It defines the margin necessary to take and maintain exposures. Using 100 % of the leverage means that the equity is actually levered to the leverage factor.

A leverage factor of 100 is attributed by default to all retail and standards accounts at account opening (1:30 the weekend). This value might be changed upon written request in the limits of the maximum authorized (some other limitations might apply).

The maximum authorized leverage attributed to large equity basis accounts is determined along with the client, before the account opening.

Margin Maintenance

The margin is defined by the equity and by the leverage authorized to the portfolio. Necessary margin to take and maintain an exposure is computed, and updates the free trading line. The margin necessary for bid/offers orders is computed and reserved as soon as order creation. Margin is calculated and maintained in real-time and is a function of the current equity, the exposures and the pending bid/offer orders.

Margin Call Level

The margin call territory is defined by the use of leverage when this latter is equal or above 100% and below 200%. When the use of leverage reaches 100%, the account enters the margin call territory and increasing the exposure is no longer allowed as the Free Margin is equal to zero. Any action that would have the effect of increasing the exposure is prohibited and bid/offers attempts are rejected. The clients have still some flexibility with respect to the management of their exposure in the margin call territory: they are allowed to either decrease the exposure or keep it.

The clients must carefully review their position structure when their account is in the margin call territory because any kind of order that would have the effect of increasing the net exposure is prohibited, whatever the profit and loss experienced on a particular position. To determine if an action is allowed, the clients should look at the net exposure in the position summary to see if the action they intent to do would have the effect of increasing or decreasing the net exposure in a particular instrument. Position merge may be required when dealing with fully, or partially hedged exposures.

The clients must be aware that, within the margin call territory, there would be no automatic exposure cover, offsetting trade, nor transactions made to decrease the exposure. The client bears the responsibility of keeping the current exposure, or to decrease it. By keeping the account exposed, the trader allows for recovery and decrease of the use of leverage, but also allows for further loss mount and further increase of the use of leverage. The clients are encouraged to carefully monitor highly exposed accounts, and to keep the use of leverage at sustainable levels.Margin Cut Level

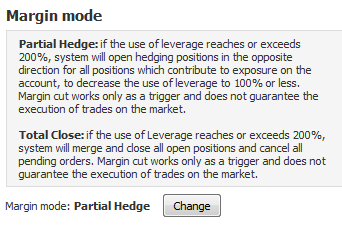

The margin cut level is reached when the use of leverage touches 200 %. Two margin modes are possible: the default one (Partial Hedge) and an alternative one (Total Close).

1 - PARTIAL HEDGE MODE (default)

When the use of leverage touches 200%, the global exposure of the trader is automatically reduced to bring the use of leverage back to 100 %. The process is automated and performed at the server level. The system offsets position(s) in every instrument in which there is an exposure. The amount of the offsetting trade is calculated as to bring the use of leverage back to 100%, the exposure is therefore cut by half.

WARNING! As the partial hedge mode does not cover the exposure entirely, the account remains exposed at high levels because the use of leverage is still at 100% after the margin cut trades. From this point, the client owns the decision making as to decrease further the exposure, cover it entirely, or keep it. The clients must be aware of the consequences of keeping hedged exposures, especially regarding the swap processing, and order management. Based on these considerations, the clients are encouraged to merge their positions after a margin cut event.

2 - TOTAL CLOSE MODE

When the use of leverage touches 200%, the system will merge and close all open positions and cancel all pending orders.

Margin cut works only as a trigger and does not guarantee the execution of trades on the market. In case of rejections, the orders will be resubmitted until the use of leverage goes below 200%.Choose your margin mode

By default, the Margin mode is “Partial Hedge”. If you want to change your margin mode, go to the report called “My Account”, you will be able to choose between the two options.