Take Profit

The Take Profit order is a conditional limit close order associated to a specific position, its condition is an absolute limit over the execution price.

It is called Take Profit because it is usually created at the time an exposure is taken and placed as a limit close should the exposure go in the profit territory. However, a Take Profit order may be placed at a time when the exposure is at loss, and the limit still be placed in the loss territory.

-

A take profit order associated to a long position is a limit order to sell the position.

-

A take profit order associated to a short position is a limit order to buy the position.

Take profit are good-till-canceled orders. Order cancellation can be performed at any time by the trader, or is performed automatically when the position is closed otherwise.

The position closure due to a take profit execution may result either in removing, reducing or increasing an exposure.

OCO

Parameters

Position: The position to which the take profit order is associated.

Amount: The amount of the order is the position amount by default and cannot be defined by the trader. It is not possible to place a take profit order on partial position amount.

Price: The absolute limit price at which the position has to be closed

Messaging

Processing

Take profit orders may be sent at the same time an entry order is sent, or may be added to a position later.Take profit orders may be defined as a default, and automatically be sent along with market orders by selecting the option Apply default Take Profit to All Market Orders. If it is so, the Take Profit order will be automatically sent when trading with quarrels, as well as trading with the conditional entry pane of the full trading pane. If the conditional order of the full trading pane is used, it is possible to modify the take profit order parameters before sending the entry order.

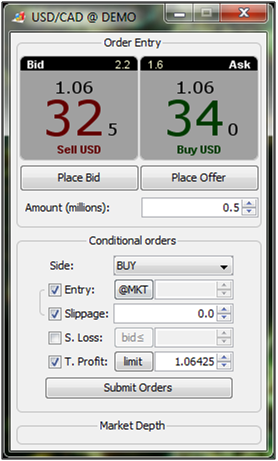

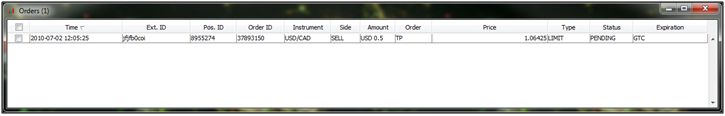

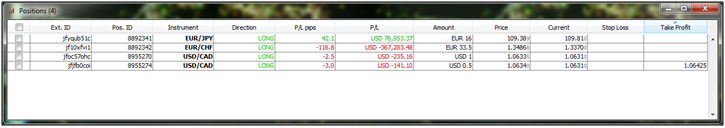

Conditional entry order at market with the Take Profit Order automatically set with the parameters defined in the preferences

12:05:25 Order FILLED at 1.0634 CAD (#37893149 BUY 0.5 mil. USD/CAD @ MKT MAX SLIPPAGE 0.000000) - Position #8955274

12:05:25 Position 8955274 TAKE PROFIT #37893150

12:05:25 Order ACCEPTED: #37893150 TAKE PROFIT SELL 0.5 mil. USD/CAD @ LIMIT 1.06425 IF BID => 1.06425 - Position #8955274

12:05:25 Order sent: TAKE PROFIT SELL 0.5 mil. USD/CAD @ LIMIT 1.06425 IF BID => 1.06425Orders pane dispatching the Take Profit order #37893150 associated to the position #8955274

Execution Process

The take profit order is sent to the marketplace for execution as soon as there is a probability for it. The execution of a take profit order to sell is attempted as soon and as long as the market bid price is equal to or above the limit of the take profit order. The execution of a take profit order to buy is attempted as soon and as long as the market ask price is equal to or below the limit of the take profit order. Negative slippage is not allowed on take profit orders therefore, the execution price can only be at the limit or better.

Take profit orders may suffer rejection, hence partial executions. The bid or ask market price triggering the take profit order may not be available when the order effectively reaches the marketplace. Other reason for rejection is the consumption of the available liquidity by concurrent orders. In case of rejection, take profit orders are resubmitted as soon and as long there is a probability of execution provided they are not canceled in the meantime by the closure of the position, or the cancellation by the trader.

Assuming that the order validation mode is disabled, a take profit order to sell, placed with a limit equal or below the market bid price at the time the order is sent, and/or a take profit order to buy placed with a limit equal or above the market ask price at the time the order is sent, will be triggered for execution immediately and without prior warning. As soon as the conditions for triggering are satisfied, the orders are sent for execution immediately.