Closing Positions

This article explains how to manually close positions in Desktop JForex3.

The trading platform offers two commands for the manual closure of positions:

- Close Position - to close the full position amount

- Conditional Close - to close parts of the position and define a slippage restriction for the closing order

Once selected, the Close commands submit market orders with the aim of closing selected positions/exposures.

NOTE: If the platform settings apply a slippage restriction to all market orders (Settings > Preferences > General), the restriction is also applied to market orders that aim to close positions.

Close Position

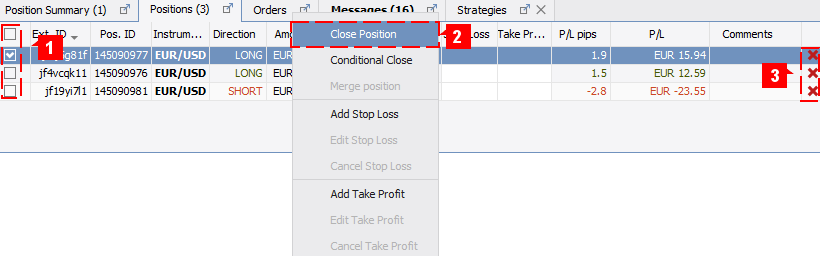

Positions Tab

In the Positions tab, you can close one or several positions at once.

- Select one or more positions (1) and right-click the selected positions to open the menu.

- Select Close Positions (X) (X indicates the number of positions) (2) from the menu and verify order execution.

Alternatively, you may click on the X (3) in the very last column of position row for the position that you would like to close. If One Click is enabled, this will directly submit a market order aiming to close the position.

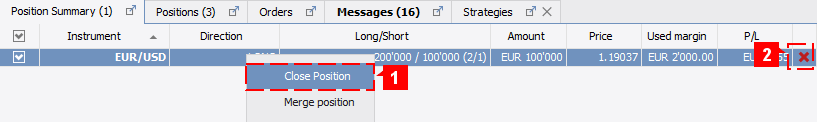

Position Summary Tab

The Position Summary tab allows you to close all open positions for the selected instrument at once.

- Right-click the instrument in the Position Summary tab to open the menu, select Close Position (1) from the menu and verify order execution.

Alternatively, you may click on the X (2) in the very last column of position row for the position that you would like to close. If One Click is enabled, this will directly submit a market order aiming to close the position.

The Close position command executed from the position summary pane will close all exposure components at the market without any consideration to the side of individual exposure components. If the position summary is composed from long and short positions (hedged positions), the Close command will close them independently by closing short positions with buy market orders, and long positions with sell market orders.

You are encouraged to merge any hedged position before closing position from the position summary pane. This will save the spread cost and commissions, since only the net exposure in the selected instruments will require a market transaction to be closed, and to one side of the market only. A perfectly hedged position (flat exposure) will be cleared by the merge operation.Chart Trading

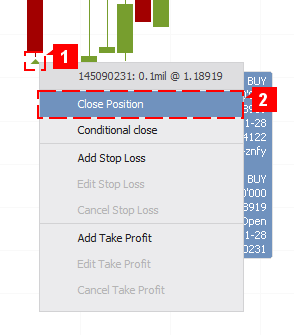

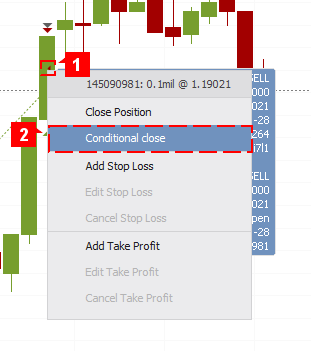

In order to use this function, chart trading needs to be enabled (Settings > Preferences > General).

-

Enable Open Positions visibility on the chart (if it is not already enabled).

-

Locate the position (green triangles for long positions, red triangles for short positions) in the chart (1) and right-click it to open the menu.

-

Click on Close Position (2) and verify order execution.

Conditional Close

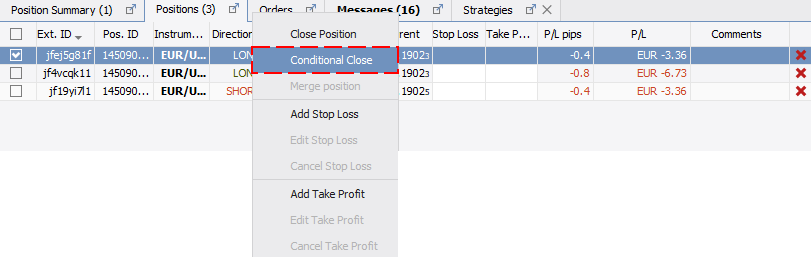

Positions Tab

The conditional close command can be executed only on a single position.

- In the Positions tab, right-click the position and select Conditional Close.

- Proceed to the Conditional Close window.

Chart Trading

In order to use this function, chart trading needs to be enabled (Settings > Preferences > General).

-

Enable Open Positions visibility on the chart (if it is not already enabled).

-

Locate the position (green triangles for long positions, red triangles for short positions) in the chart (1) and right-click it to open the menu.

-

Click on Conditional Close (2) and proceed to the Conditional Close window.

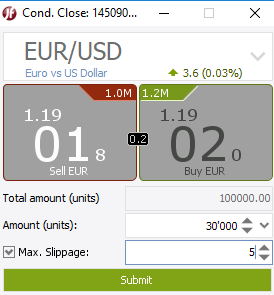

Conditional Close window

- Specify the Amount that you would like to close (here 30 000 of the 100 000 position will be closed).

- Optionally, you may define a slippage restriction in the Max. Slippage field which is applied to this closing order.

- Click on Submit and verify order execution.