Rollovers

This article explains rollovers and swaps.

All positions (and exposures) which are open at settlement, are 'rolled over' to the next trading day (21:00/22:00 GMT, depending on the summer/winter season) in order to avoid physical delivery/receipt of the instrument traded.

During this process, which is also known as 'overnight procedure', 'carry' or 'position roll', swap charges or credits are applied.

Positions that are closed during the trading day are not 'rolled over'.

Rollover process

At settlement, an open position (or exposure) is closed for the past trading day at the settlement price and simultaneously re-opened for the new trading day at the settlement price +/- the applicable overnight adjustment (swap charge or credit).

The trades are labeled as Rollover Close and Rollover Open respectively in the portfolio statement and intraday reports.

Calculation

The size of the overnight adjustment is defined by the overnight swap rate and the value dates of the Rollover close and Rollover open transactions.

Overnight Swap Rate

The overnight swap rates are calculated by the broker on the basis of interbank market overnight swaps and its own carry costs. Updates occur frequently and without prior notice and the current overnight swaps rates can be found on the broker's website.

The broker reserves the right to alter or modify the swap rate schedule, and/or the conditions of its attribution in full or in part, at any time and without prior notice. In addition, the swap rates published on the websites cannot be taken as a proxy for the rates effectively applied.The swap rates are given in pips and you can find an example in the table below:

| Instrument | Long (pips) | Short (pips) |

|---|---|---|

| EUR/USD | 0.71 | 0.63 |

During the rollover process, a EUR/USD long position would be reopened at the settlement price + 0.71 pips. Easier said, you 'buy' at a higher price, hence, you are charged a swap of 0.71 pips.

On the other side, a EUR/USD short position would be reopened at the settlement price +0.63 pips. As you now 'sell' at a higher price, you receive a swap credit of 0.63 pips.

The swap rates presented here are used an example and the current swap rate may be different. Value Date

Spot transactions typically have the value date T+2. This means that two business days from the trade date, transactions are to be settled physically (if positions are not 'rolled over'). Some instruments have different value dates, notably USD/CAD, USD/TRY or USD/RUB with T+1. If the value date falls on a holiday or weekend, it is shifted to the next business day.

The value date is important for the calculation of rollovers as the difference between the value dates for the rollover trades define, how many times the overnight swap rate is applied. For instruments with value date T+2, swaps are typically applied one time per settlement while on Wednesday nights, triple swaps are applied. As a result of holidays, multiple swaps or no swaps at all may be applied.

These are simplified examples, assuming that there are no holidays during the period, unless stated otherwise.

Example 1: EUR/USD position, open at settlement on Monday evening, 'rolled over' to Tuesday.

- Trade date -> Value Date

- Monday -> Wednesday

- Tuesday -> Thursday

- Swap on Monday -> 1x

Example 2: EUR/USD position, open at settlement Monday evening, 'rolled over' to Tuesday, Wednesday is a holiday

- Trade date -> Value Date

- Monday -> Thursday

- Tuesday -> Thursday

- Swap on Monday -> 0x

Example 3: EUR/USD position, open at settlement on Wednesday evening, 'rolled over' to Thursday.

- Trade date -> Value Date

- Wednesday -> Friday

- Thursday -> Monday

- Swap on Wednesday -> 3x

Rollover Reports

There are several ways to follow and monitor the swaps that were gained or paid for the positions.

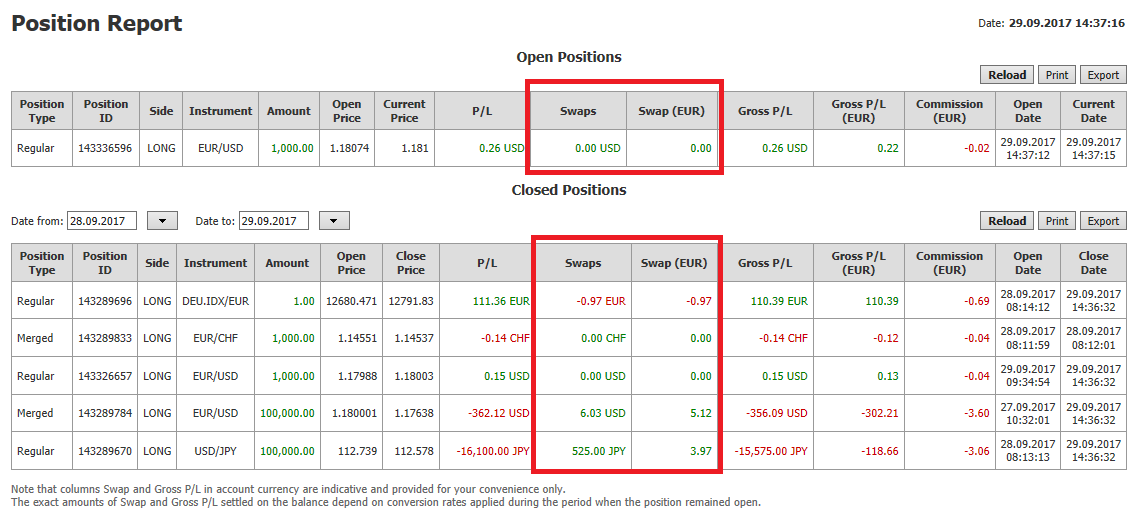

Position report

Accrued swaps are displayed in the position report in the column Swaps in the quote currency of the instrument. An indicative value in the account base currency is given in Swaps (CCY).

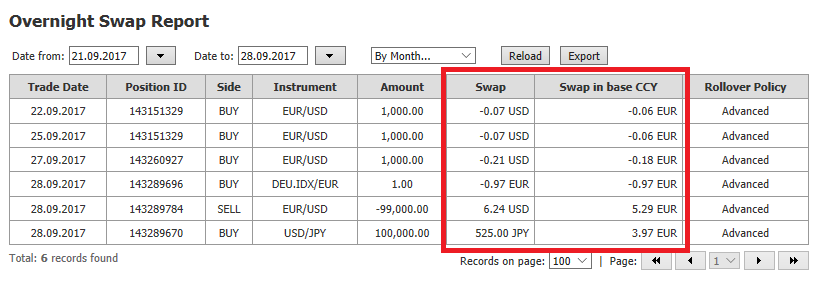

Overnight Swap Report

This report is part of Rollover Policy (Account > Rollover Policy) and lists the swaps per position per day.

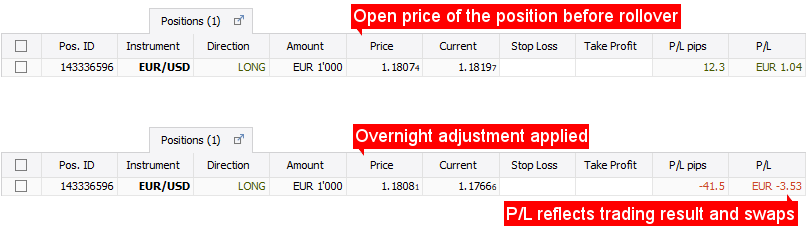

Trading platform

The trading platform does not display swaps in a separate column. Instead, if an position is 'rolled over', the opening price (Price) which is displayed in the positions tab, is adjusted. Therefore, P/L reflects the trading result of the position and accrued swaps.

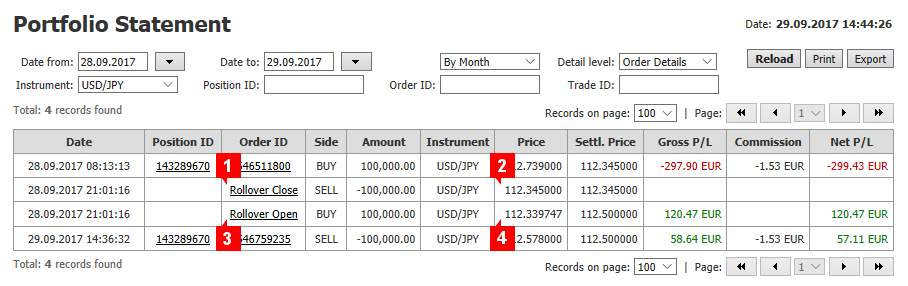

Portfolio Statement

While the portfolio statement does not show the accrued swaps directly, it provides a full account of the rollover process as it shows the individual Rollover Close and Rollover Open trades.

In the portfolio statement, set the Detail level to Order Details or Trade Details

The position was closed by the Rollover Close trade (1) at the settlement price of 112.345 (2) and simultaneously reopened by the Rollover Open trade (3) at the rate of 112.339747 (4), which is the settlement price minus the overnight price adjustment. The difference between 112.345 - 112.339747 is the swap rate (0.5253 pips) that was applied to the position.

Hedged exposures

Each position is 'rolled over' independently and separately from each other, whatever the net exposure would be. That implies that hedged exposures always incur a swap cost as the net cost between long and short exposures in a given instrument is always negative due to the spread in swap rates.