Stop Entry

Triggered orders necessitate a market trigger in order to be sent for execution attempt. For that kind of order, triggers are required to attempt execution of stop and limit orders. Typically, triggered orders remain pending at the time of their creation because the conditions for their execution are not satisfied at the time they are created. It does not mean, however, that a triggered order cannot be executed immediately when it is created and sent. If the trigger, or conditions set in the order are immediately satisfied by the market at the time the order is created, then the order is sent for execution immediately. Triggered orders may or may not embed relaxing conditions about the execution price relative to the trigger. And such relaxing conditions, when they exist, may or may not be under the control of the trader, as the reader will see in the description of each order type.

Once triggered, any triggered order will either be executed or rejected, in full or in part. However, rejected triggered orders are not canceled by the event of rejection; they are resubmitted if there is any probability of execution, immediately or later, depending on the conditions set in the order. Depending on the type of triggered order, the trigger status and order identification will change also after a rejected attempt of execution.

Unless the validation for orders is enabled, and the mode one-click is disabled, there is no warning in the case a triggered order is sent with conditions immediately satisfied by the current market, in other words, if an order is triggered immediately upon creation. Traders making an extensive use of the one-click mode should carefully review their triggered orders before sending them to determine if the conditions are consistent with their intentions, and if such order is likely to sent for execution immediately when created.The stop entry order aims to enter the market should a predefined level be reached by the market price. It is usually used to attempt entering the market in the direction of the immediate trend.

The stop entry orders are good till canceled orders by default. They remain pending as long as they are not executed, nor canceled, either by the trader, or for reasons due to margin maintenance requirements.

The stop entry order is an order to open and can be used to take, flatten, reduce or increase an exposure.

The execution price may be constrained or not. The constraint for execution is defined with the slippage control, is relative to the trigger price and establishes a limit to the order. Entry Stop order with applied Max.Slippage is defined as STOP LIMIT order.

Stop entry orders with applied slippage control become limit orders once they have been triggered, and have suffered rejection eventually. The full order, or the amount that failed to execute upon triggering, will remain pending as a good-till-canceled limit order at the price defined as initial stop price corrected with Max.Slippage value applied in initial Stop order. The order will be executed should the market reaches the limit level later. In case the trader does not want to keep the limit order, he must cancel it manually. Once the stop entry order is converted to a stop limit order, the processing and execution process of the stop limit orders apply.Parameters

Amount

The amount of the order to execute, defined by the trader. The default amount value is the one set in the preferences and can be modified upon order creation and as long as the order is in the pending status.

Side

Buy or sell order defined by the trader.

Price

The market side reference and the trigger price.

The market reference is either:

- Bid >=

- Bid <=

- Ask >=

- Ask <=

It represents the market variable that will be checked for triggering.

Max.Slippage

The allowed deviation for execution, relative to the trigger price, defined by the trader.

- If disabled the triggered order is a market order.

- If enabled, the triggered order is a limit order, whose limit is defined as the amount of allowed slippage relative to the trigger price.

Messaging

The action of sending a stop entry order and according consequences are recorded in the messages log, activity log, trade log and other reporting sections if appropriate.

Processing

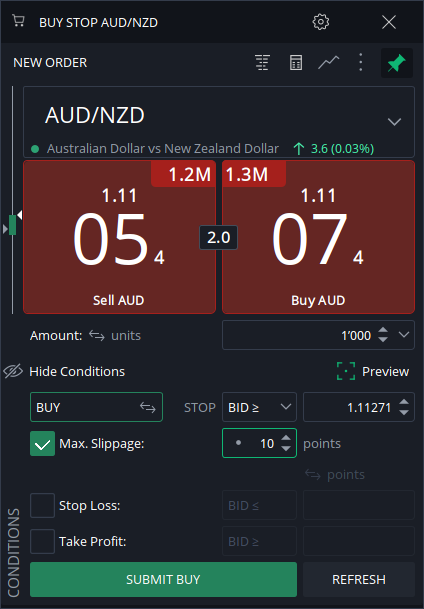

Stop entry orders are set and launched from the New order pane.

Buy Stop if BID >=

The stop entry buy order launches a buy order when the market bid price is equal or above the trigger price. It remains pending otherwise.

If the slippage control is disabled, the buy order is sent at the market when triggered.

2024-07-24 13:19:25 Order ACCEPTED: #990172709 STOP BUY 0.001 mil. AUD/NZD @ MKT IF BID => 1.11271 EXPIRES: GTC - Position #239227337

2024-07-24 13:19:25 Order STOP BUY 1’000 AUD/NZD @ MKT IF BID => 1.11271 has been sent at 2024-07-24 13:19:25 manually

2024-07-24 13:19:25 Sending order: STOP BUY 1’000 AUD/NZD @ MKT IF BID => 1.11271

If the slippage control is enabled, the buy order is sent limited when triggered.

2024-07-24 13:19:56 Order ACCEPTED: #990172717 STOP LIMIT BUY 0.001 mil. AUD/NZD @ LIMIT 1.11371 IF BID => 1.11271 EXPIRES: GTC - Position #239227340

2024-07-24 13:19:56 Order STOP LIMIT BUY 1’000 AUD/NZD @ LIMIT 1.11371 IF BID => 1.11271 has been sent at 2024-07-24 13:19:56 manually

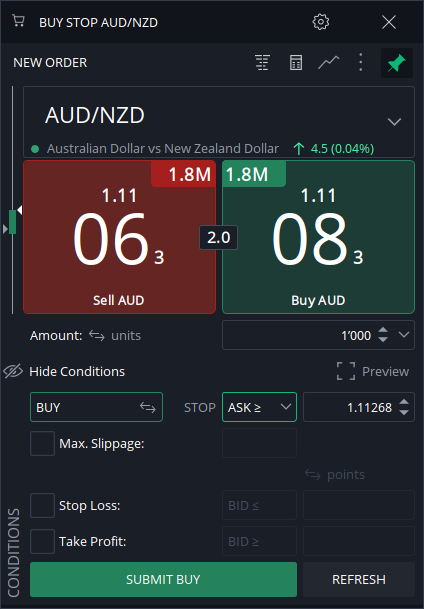

2024-07-24 13:19:56 Sending order: STOP LIMIT BUY 1’000 AUD/NZD @ LIMIT 1.11371 IF BID => 1.11271 In one-click mode, if the order is sent and the trigger price is equal or below the current market bid price, the order will be immediately sent for execution.Buy Stop if ASK >=

The stop entry buy order launches a buy order when the market ask price is equal or above the trigger price. It remains pending otherwise.

If the slippage control is disabled, the buy order is sent at the market when triggered.

2024-07-24 13:23:28 Order ACCEPTED: #990172911 STOP BUY 0.001 mil. AUD/NZD @ MKT IF ASK => 1.11268 EXPIRES: GTC - Position #239227385

2024-07-24 13:23:28 Order STOP BUY 1’000 AUD/NZD @ MKT IF ASK => 1.11268 has been sent at 2024-07-24 13:23:28 manually

2024-07-24 13:23:28 Sending order: STOP BUY 1’000 AUD/NZD @ MKT IF ASK => 1.11268

If the slippage control is enabled, the buy order is sent limited when triggered.

2024-07-24 13:24:30 Order ACCEPTED: #990172940 STOP LIMIT BUY 0.001 mil. AUD/NZD @ LIMIT 1.11368 IF ASK => 1.11268 EXPIRES: GTC - Position #239227393

2024-07-24 13:24:30 Order STOP LIMIT BUY 1’000 AUD/NZD @ LIMIT 1.11368 IF ASK => 1.11268 has been sent at 2024-07-24 13:24:30 manually

2024-07-24 13:24:30 Sending order: STOP LIMIT BUY 1’000 AUD/NZD @ LIMIT 1.11368 IF ASK => 1.11268 In one-click mode, if the order is sent and the trigger price is equal or below the current market ask price, the order will be immediately sent for execution.Sell Stop if BID <=

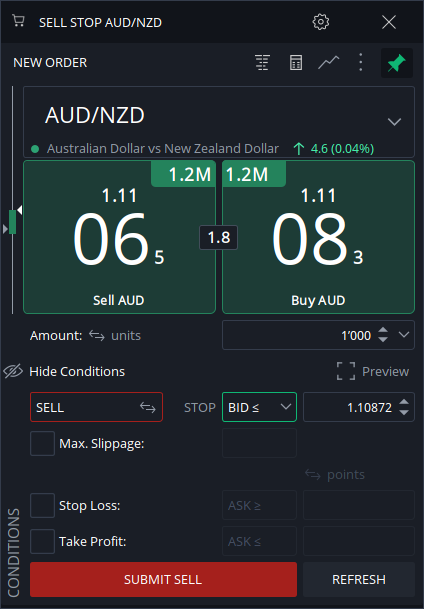

The stop entry sell order launches a sell order when the market bid price is equal or below the trigger price. It remains pending otherwise.

If the slippage control is disabled, the sell order is sent at the market when triggered.

2024-07-24 13:31:01 Order ACCEPTED: #990173381 STOP SELL 0.001 mil. AUD/NZD @ MKT IF BID <= 1.10872 EXPIRES: GTC - Position #239227440

2024-07-24 13:31:01 Order STOP SELL 1’000 AUD/NZD @ MKT IF BID <= 1.10872 has been sent at 2024-07-24 13:31:01 manually

2024-07-24 13:31:01 Sending order: STOP SELL 1’000 AUD/NZD @ MKT IF BID <= 1.10872

If the slippage control is enabled, the sell order is sent limited when triggered.

2024-07-24 13:34:02 Order ACCEPTED: #990176720 STOP LIMIT SELL 0.001 mil. AUD/NZD @ LIMIT 1.10772 IF BID <= 1.10872 EXPIRES: GTC - Position #239227526

2024-07-24 13:34:01 Order STOP LIMIT SELL 1’000 AUD/NZD @ LIMIT 1.10772 IF BID <= 1.10872 has been sent at 2024-07-24 13:34:01 manually

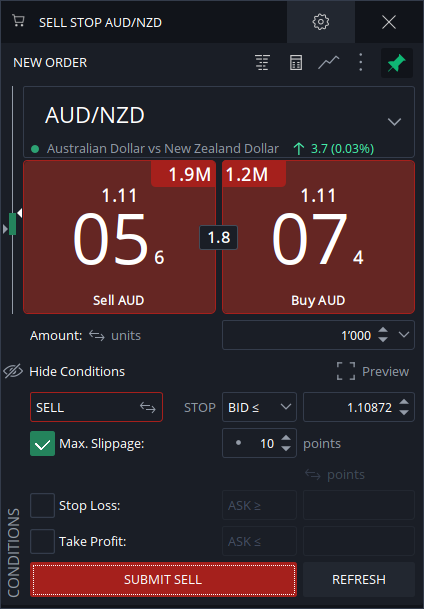

2024-07-24 13:34:01 Sending order: STOP LIMIT SELL 1’000 AUD/NZD @ LIMIT 1.10772 IF BID <= 1.10872 In one-click mode, if the order is sent and the trigger price is equal or above the current market bid price, the order will be immediately sent for executionSell Stop if ASK <=

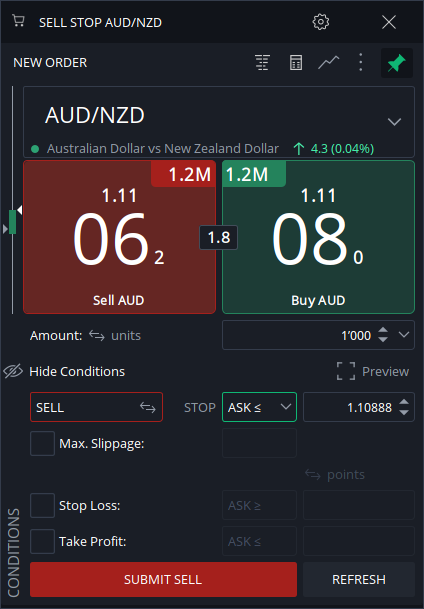

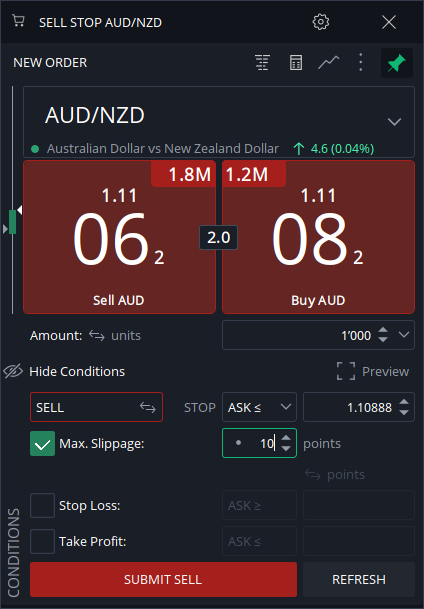

The stop entry sell order launches a sell order when the market ask price is equal or below the trigger price. It remains pending otherwise.

If the slippage control is disabled, the sell order is sent at the market when triggered.

2024-07-24 13:35:04 Order ACCEPTED: #990176859 STOP SELL 0.001 mil. AUD/NZD @ MKT IF ASK <= 1.10888 EXPIRES: GTC - Position #239227545

2024-07-24 13:35:04 Order STOP SELL 1’000 AUD/NZD @ MKT IF ASK <= 1.10888 has been sent at 2024-07-24 13:35:04 manually

2024-07-24 13:35:04 Sending order: STOP SELL 1’000 AUD/NZD @ MKT IF ASK <= 1.10888

If the slippage control is enabled, the sell order is sent limited when triggered.

2024-07-24 13:35:36 Order ACCEPTED: #990176870 STOP LIMIT SELL 0.001 mil. AUD/NZD @ LIMIT 1.10788 IF ASK <= 1.10888 EXPIRES: GTC - Position #239227548

2024-07-24 13:35:36 Order STOP LIMIT SELL 1’000 AUD/NZD @ LIMIT 1.10788 IF ASK <= 1.10888 has been sent at 2024-07-24 13:35:36 manually

2024-07-24 13:35:36 Sending order: STOP LIMIT SELL 1’000 AUD/NZD @ LIMIT 1.10788 IF ASK <= 1.10888 In one-click mode, if the order is sent and the trigger price is equal or above the current market ask price, the order will be immediately sent for execution.Execution Process

Once the stop entry order is created, and assuming that the conditions for triggering are not yet satisfied; the order remains in a pending status. Moreover, once such an order is accepted on the server, the triggering and processing of the order does not depend anymore on the status of the client application. As soon as the market reaches the trigger by the market reference criterion, the order is sent for execution as a market or limit order.

The trigger price is not the execution price. Unless the slippage control is enabled and the slippage value is set to zero, it is highly likely that the execution price differs from the trigger price. When the trigger price is reached, it triggers the sending of the order to the marketplace, at which time the market price could have moved from the trigger price, the execution price depends then on the conditions set for execution. If the slippage control is enabled and its value set to zero, the stop entry order is effectively limited, and its limit is the trigger price. Moreover, if stop entry orders are triggered during a volatile market phase, it is very likely that the liquidity may no longer be available at the trigger price.Margin Requirements

The margin requirements for stop entry orders are calculated when the orders are sent for execution only. Margin is not reserved as long as stop entry orders remain pending. Should the margin be not enough to cover the full execution of the market order, the part of the order not covered by the margin will be rejected and only the amount covered by the margin will be sent for execution.