MIT Entry

The Entry MIT order is either a conditional market or limit order to open a position. Its condition is a trigger price and its primary purpose is to relax the constraint on the execution price once the market level has triggered the entry order. The constraint on the execution price can be placed still by setting a zero slippage value. In such case, the entry MIT order is strictly equal to an entry limit order.

The MIT order can be used to open, reduce, or increase an exposure.

Parameters

Amount

The amount of the order to execute, defined by the trader. The default amount value, as well as the unit, are set in the preferences and can be modified upon order creation and as long as the order is in the pending status.

Max.Slippage

The maximum amount of deviation allowed for execution relative to the trigger price when the order is triggered and sent for execution, defined by the trader. The default value is the value set in the preferences and can be modified upon order creation, and as long as the order is in the pending status. Any slippage value defines a limit for the execution price relative to the trigger price. If the slippage value is set to zero, the limit is equal to the trigger price.

Messaging

The action of sending a stop entry order and according consequences are recorded in the messages log, activity log, trade log and other reporting sections if appropriate.

Processing

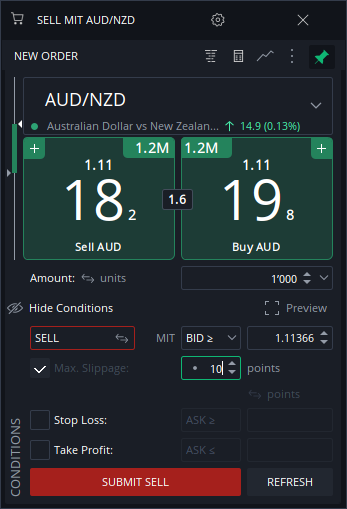

MIT entry orders are set and launched from the New order pane.

Buy LIMIT

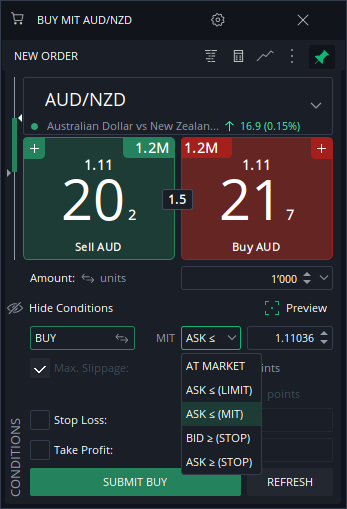

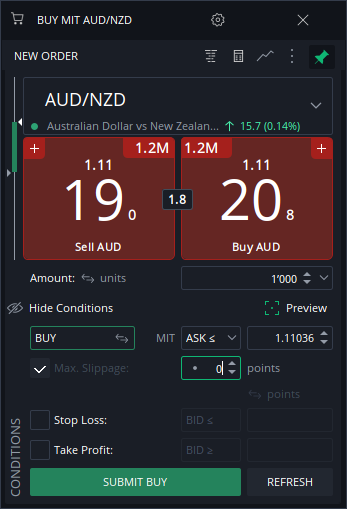

New order entry window Entry MIT Buy order with Max.Slippage equal to 0

2024-07-26 12:15:17 Order ACCEPTED: #990590084 LIMIT BUY 0.001 mil. AUD/NZD @ LIMIT 1.11036 IF ASK <= 1.11036 EXPIRES: GTC - Position #239277412

2024-07-26 12:15:17 Order LIMIT BUY 1’000 AUD/NZD @ LIMIT 1.11036 IF ASK <= 1.11036 has been sent at 2024-07-26 12:15:17 manually

2024-07-26 12:15:17 Sending order: LIMIT BUY 1’000 AUD/NZD @ LIMIT 1.11036 IF ASK <= 1.11036 Buy MIT

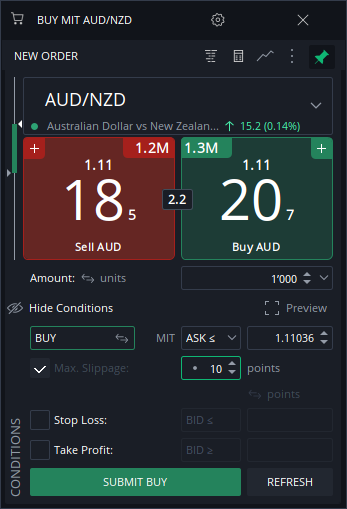

New order entry window Entry MIT Buy order with Max.Slippage NOT equal to 0

2024-07-26 12:17:30 Order ACCEPTED: #990590134 MIT BUY 0.001 mil. AUD/NZD @ LIMIT 1.11136 IF ASK <= 1.11036 EXPIRES: GTC - Position #239277424

2024-07-26 12:17:30 Order MIT BUY 1’000 AUD/NZD @ LIMIT 1.11136 IF ASK <= 1.11036 has been sent at 2024-07-26 12:17:30 manually

2024-07-26 12:17:30 Sending order: MIT BUY 1’000 AUD/NZD @ LIMIT 1.11136 IF ASK <= 1.11036 Sell LIMIT

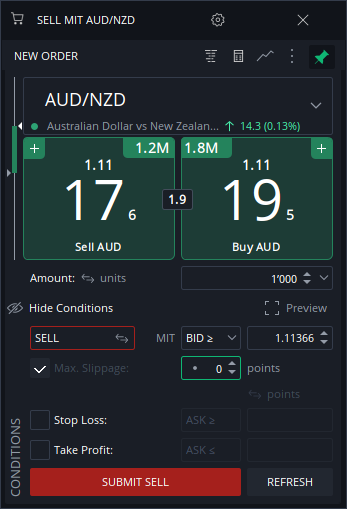

New order entry window Entry MIT Sell order with Max.Slippage equal to 0

2024-07-26 12:26:45 Order ACCEPTED: #990590445 LIMIT SELL 0.001 mil. AUD/NZD @ LIMIT 1.11366 IF BID => 1.11366 EXPIRES: GTC - Position #239277490

2024-07-26 12:26:45 Order LIMIT SELL 1’000 AUD/NZD @ LIMIT 1.11366 IF BID => 1.11366 has been sent at 2024-07-26 12:26:45 manually

2024-07-26 12:26:45 Sending order: LIMIT SELL 1’000 AUD/NZD @ LIMIT 1.11366 IF BID => 1.11366 Sell MIT

New order entry window Entry MIT Sell order with Max.Slippage NOT equal to 0

2024-07-26 12:26:58 Order ACCEPTED: #990590446 MIT SELL 0.001 mil. AUD/NZD @ LIMIT 1.11266 IF BID => 1.11366 EXPIRES: GTC - Position #239277491

2024-07-26 12:26:58 Order MIT SELL 1’000 AUD/NZD @ LIMIT 1.11266 IF BID => 1.11366 has been sent at 2024-07-26 12:26:58 manually

2024-07-26 12:26:58 Sending order: MIT SELL 1’000 AUD/NZD @ LIMIT 1.11266 IF BID => 1.11366 Execution Process

Once the MIT entry order is created, and assuming that the conditions for triggering are not yet satisfied; the order remains in a pending status. Moreover, once such an order is accepted on the server, the triggering and processing of the order does not depend anymore on the status of the client application. As soon as the market reaches the trigger by the market reference criterion, the order is sent for execution as a market or limit order.

The trigger price is not the execution price. Unless the slippage control is enabled and the slippage value is set to zero, it is highly likely that the execution price differs from the trigger price. When the trigger price is reached, it triggers the sending of the order to the marketplace, at which time the market price could have moved from the trigger price, the execution price depends then on the conditions set for execution. If the slippage control is enabled and its value set to zero, the MIT entry order is effectively limited, and its limit is the trigger price. Moreover, if MIT entry orders are triggered during a volatile market phase, it is very likely that the liquidity may no longer be available at the trigger price.Margin Requirements

The margin requirements for MIT entry orders are calculated when the orders are sent for execution only. Margin is not reserved as long as MIT entry orders remain pending. Should the margin be not enough to cover the full execution of the market order, the part of the order not covered by the margin will be rejected and only the amount covered by the margin will be sent for execution.