Account Activation

This article explains how to activate/deactivate a managed account from the client's perspective.

In a PAMM account, the client allows a money manager, which was appointed by the client, to trade on their behalf on the basis of a limited trading power of attorney. However, before the manager gets to use the client's funds, the client needs to set up a stop loss level and activate the account through the reports.

Clients have no access to the trading platform but can monitor their account and the trading activity of the manager through their reports.How to log into the reports?

- Go to Client Reports

- Enter your login, password and PIN code. If you need help, consult the login instructions.

Equity stop loss

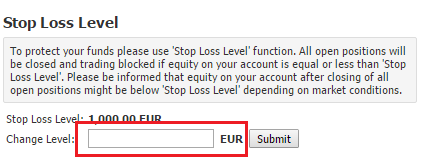

Before you can activate the account, you need to set up the Stop Loss Level. It is set in the account base currency and acts as a trigger. Once the equity of the client is equal or below the equity stop loss level, all open positions of the client are closed and further trading on the client's account by the manager is disabled as the account becomes deactivated.

- Go to the My Account section in your reports

- In the Change Level text box of the Stop Loss Level panel, input the amount and click on Submit.

The stop loss level can be changed at any time.

This stop loss level is not to be confused with the minimum equity requirement necessary to maintain any account (which is also not to be confused with the minimum equity required to open an account).

We do not guarantee the precise execution of the Stop loss level amount which was entered by the client. Be informed that especially during fast markets or gaps, there is the probability of large slippage which cause a big loss.How to activate the account?

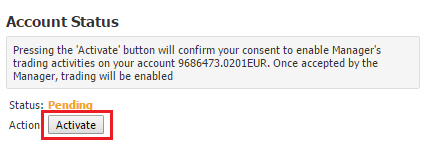

In order to activate your account, please do the following:

- Prior to initial activation, set your stop loss level.

- Go to the My Account section in your reports.

-

In the Account Status panel, click on Activate.

- In the pop-up window, click on OK.

-

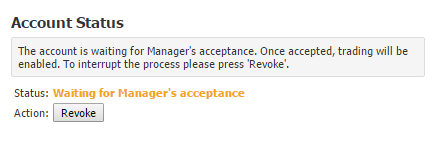

The account status changes to Waiting manager's acceptance. If you would like to interrupt the process, press Revoke.

- After the manager accepts the client, the client joins the manager.

How to deactivate the account?

In order to deactivate your account and block the manager from trading, the procedure is quite similar:

- Go to the My Account section in your reports.

- In the Account Status panel, click on Deactivate. In the pop-up window, click on OK.

The client may deactivate anytime and the recalculation of the ratios will be done immediately. All open positions on the account will be closed immediately except for off-market hours when deactivation will become effective at the opening of the market and positions will be closed at the opening price.

The account can be reactivated at any time.

The deactivation of the account and the fund withdrawal are two separate processes. Deactivation does not imply a fund movement on the account and a withdraw does not deactivate the account (except if the Stop Loss Level is reached).Performance monitoring

The client reports consists of two main sections which give access to both detailed and consolidated reports.

Summary

Under My Account you find consolidated information about your account. Account Info shows your balance, current equity, intraday profit/loss and any deposits/withdrawals made during the day. Dailiy activity shows all opened/closed positions for the current trading day..

Reports

The Portfolio Statement provides both an consolidated overview and various detail levels showing all trades done by the manager, while the Intraday Statement provides an overview of the trades done during the current day.

The intraday statement does not include commissions