© Dukascopy Bank

"The strength of the US dollar weighed on EUR which in turn fueled a broad risk aversion in financial markets"

- Societe Generale (based on WSJ)

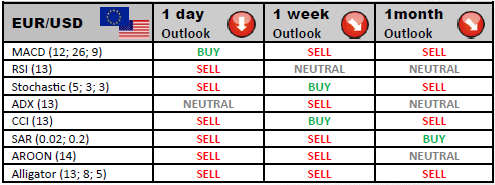

пЃ® Industry outlook

In case EUR/USD rebounds from 1.2930/44 and climbs as high as 1.30, upward correction might continue for some time more, up to 1.3160. However, should 1.2944 be breached, the pair is likely to target 1.2870 first and 1.2590 afterwards.

пЃ® Traders' sentiment

Traders' sentiment for EUR/USD currency pair has turned around and became bullish, as the share of long positions (55.56%) now exceeds the portion of short ones (44.44%), while the Euro is currently the most popular currency among its major counterparts.

пЃ® Long position opened

Investors should pay attention to the identified with the help of the standard pivot point method resistance zones, as they might be useful during intraday trading. The initial resistance level is at the level of 1.3043, whereas R2 and R3 are situated at 1.3145 and 1.3211 accordingly.

пЃ® Short position opened

Major FX traders expect the price to test the initial support level at 1.2875. The breakout of this line will pave the way for the price to test S2 at 1.2809 and S3 at 1.2707.

© Dukascopy Bank