Choose from 8 asset classes and get access to 1200+ trading instruments

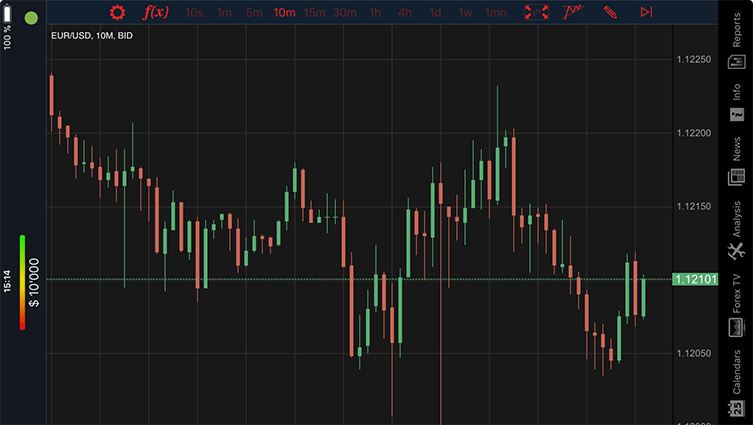

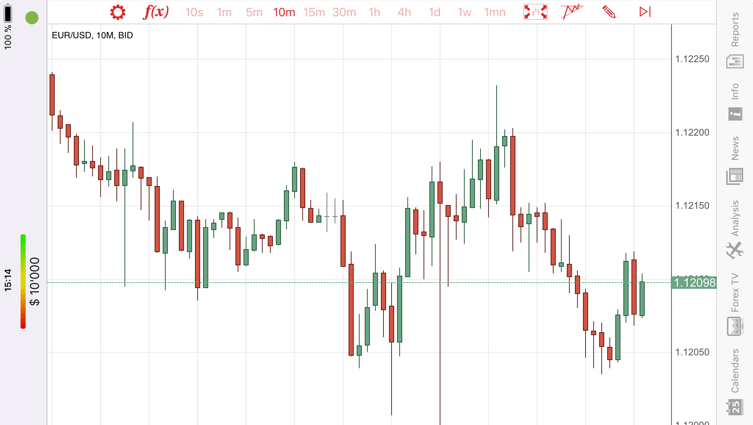

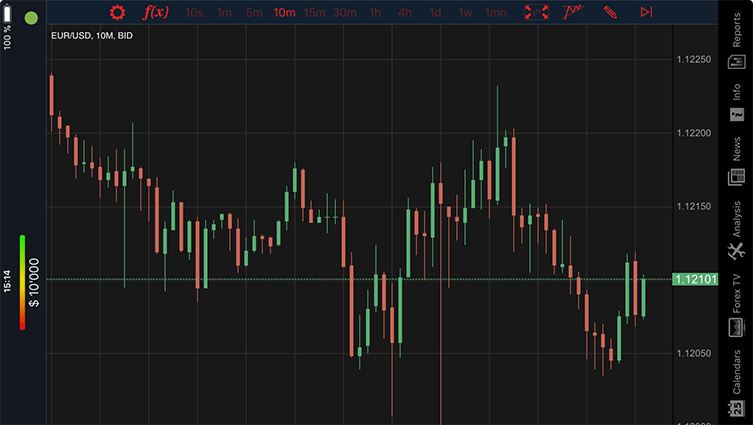

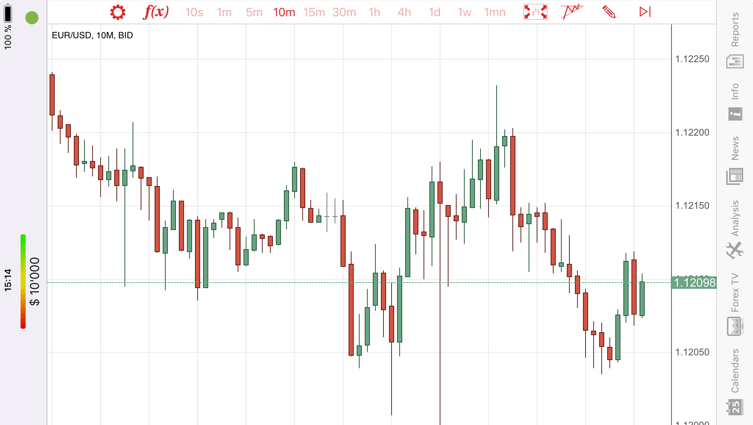

See the history of the best BID/ASK price movement. Build any charts - including Renko, Kagi or Line break, with fully customizable settings. This becomes even more important for automated strategies testing.

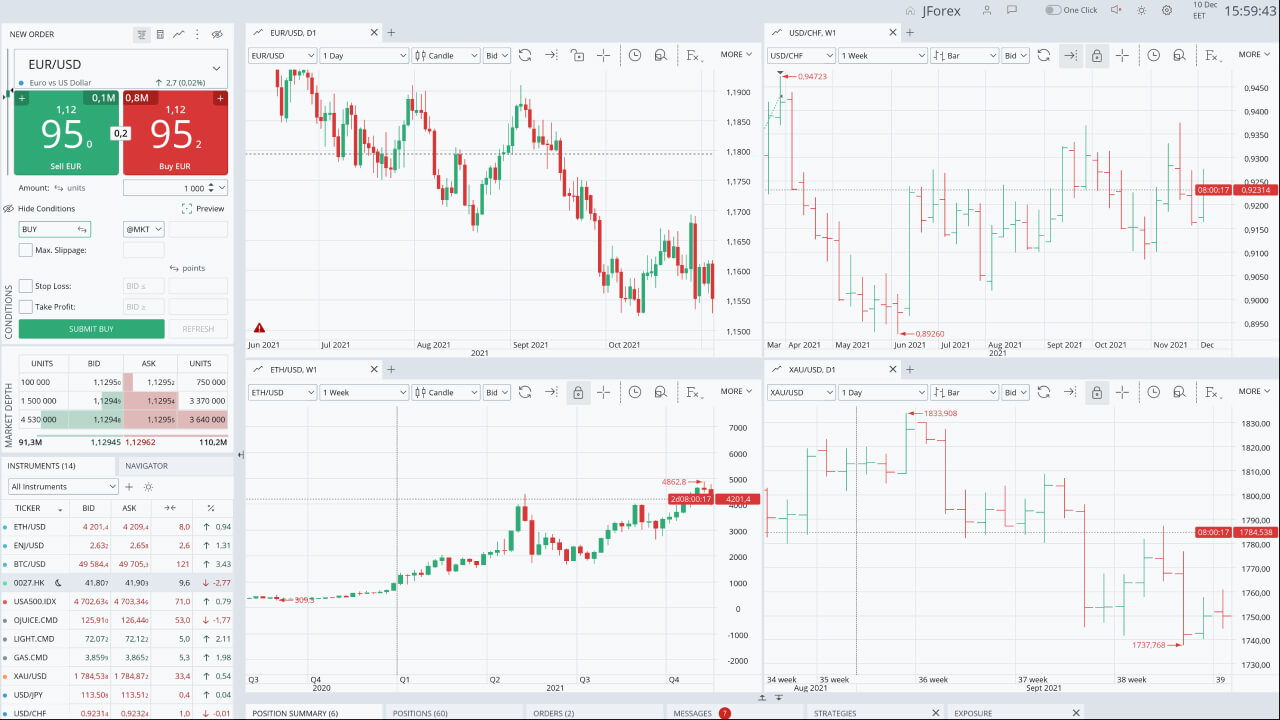

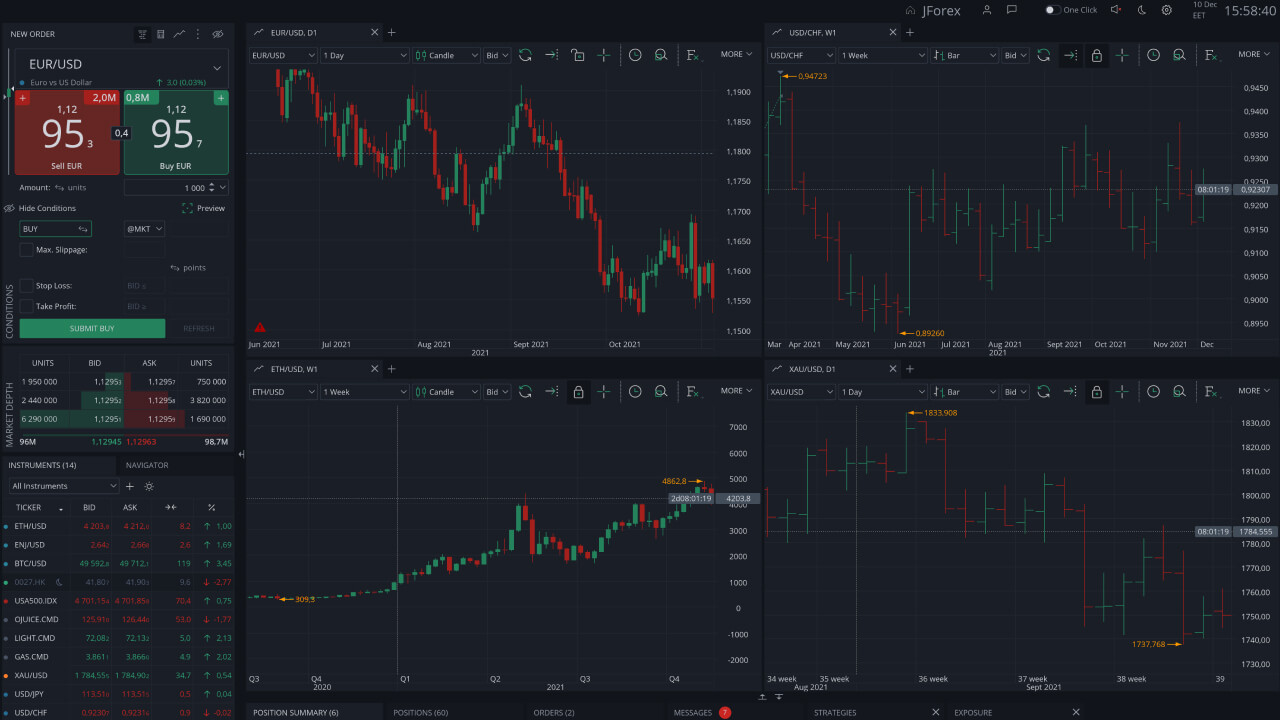

Enable the maximum slippage option to set the limit of the possible worse price for market or stop type orders. Set it to zero to eliminate worse executions completely.

This granularity helps the traders determine the magnitude of buy and sell orders at different prices. It shows where the most orders are concentrated.

Open your trading platform on any computer with the layout and chart templates synchronized.

See the data of the economical events and their impact right on the chart.

Monitor your exposure by assets, instruments or positions. Build your trading strategies wiser.

Respond to market changes by monitoring distance till your Take Profit & Stop Loss levels, opening price and current market price - all in one place.

Great selection of indicators and drawing tools take your trading to the next level.

Add your favorite Forex and CFD instruments and follow daily highs and lows.

| Functionality at Dukascopy | JFOREX | Apple iOS | Web | Android |

|---|---|---|---|---|

| Slippage control | ||||

| Place BID/Place OFFER orders(4) | ||||

| Hedging support | (1) | |||

| "Net Position(4)" mode | ||||

| Technical analysis tools | (2) | (2) | (2) | |

| News and analytics toolstools | ||||

| Market Alerts | ||||

| Communication tools | ||||

| Automated trading (strategies builder) | (3) | |||

| Multi-lingual interface | ||||

| Customized settings | ||||

| Frequency of updates set-up | ||||

| Trailing Stop Orders | (1) | |||

| One-click Mode |

JForex 4 offers traders the opportunity to trade over 1200 instruments across eight asset classes, including forex and CFD. MT4 and MT5 provide access to 108 instruments, including popular currency pairs.

The best trading platform is dependent upon your experience, requirements, and preferences. Dukascopy offers a range of platforms, including MT5 and MT4, as well as the advanced JForex 4, each with distinct advantages for currency trading. MT4 and MT5 allow trading of up to 108 assets, while JForex 4 enables trading of over 1200 instruments. Research and compare features such as charting tools, mobile apps, and automated trading capabilities to find the platform that best suits you.

Online currency trading involves selecting a regulated forex broker, opening a trading account, and depositing funds. Once you have gained familiarity with the basics (pips, leverage, and margin), you can develop a trading strategy (technical or fundamental analysis) and practice with a demo account. When you are ready, you can start with small trades and utilize risk management tools like stop-loss orders to limit potential losses as you navigate the dynamic forex market.

Currency trading can be suitable for beginners, but it requires a solid understanding of the forex market and a disciplined approach. The market's high liquidity and potential for profit attract many new traders; however, the significant risks and volatility mean that thorough education and careful planning are essential. Beginners should start with a demo account to practice trading strategies without financial risk and gradually transition to live trading as they gain experience and confidence.

These are the simple steps to start trading:

If you want to learn currency trading, you need to start by studying the fundamentals. There are plenty of online courses, books, and tutorials out there that will teach you everything you need to know about the forex market, including the basics, technical and fundamental analysis, and trading strategies. Use a demo account offered by Dukascopy Bank to practice what you've learned. Additionally, join online trading communities, follow market news, and consider attending webinars or workshops to stay updated on market trends and deepen your understanding. Review and refine your strategies continuously, based on your experiences and evolving market conditions.

For beginners, major currency pairs, such as EUR/USD, USD/JPY, GBP/USD, might be a good starting point. These pairs tend to be more liquid (meaning easier to buy and sell) and have tighter spreads, which can be helpful when starting out. However, even these major pairs can be volatile, so it is advisable to prioritize education, risk management, and practicing with a demo account before risking real money.