Note: This section contains information in English only.

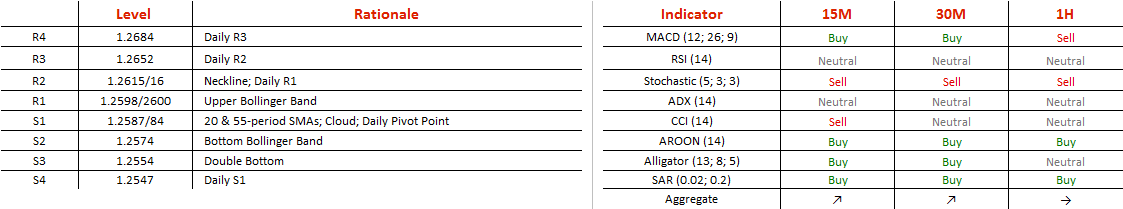

The two-day dip of GBP/USD has allegedly come to an end with a double bottom formation, which has not broken the neckline yet. The pair is currently trading mid-pattern and is expected to target the neckline at 1.2615 next. The daily Pivot point at 1.2584, bolstered by the Ichimoku cloud as well as the 55 and 20-period SMAs, has now set support for the rate, which is likely to encounter 1.2598 on its way north. The first level to watch above the neckline will be 1.2635/36, where the weekly Pivot point and 200-period SMA cluster. A continuation of the current flatness would make it harder to establish a trend, as the pair would then enter a red cloud.

The two-day dip of GBP/USD has allegedly come to an end with a double bottom formation, which has not broken the neckline yet. The pair is currently trading mid-pattern and is expected to target the neckline at 1.2615 next. The daily Pivot point at 1.2584, bolstered by the Ichimoku cloud as well as the 55 and 20-period SMAs, has now set support for the rate, which is likely to encounter 1.2598 on its way north. The first level to watch above the neckline will be 1.2635/36, where the weekly Pivot point and 200-period SMA cluster. A continuation of the current flatness would make it harder to establish a trend, as the pair would then enter a red cloud.

Mon, 12 Dec 2016 07:39:02 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.