Note: This section contains information in English only.

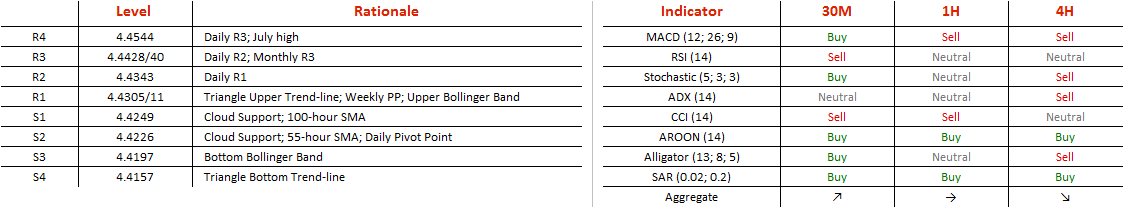

The one and a half month surge proved too much for EUR/PLN, leading to a consolidation inside a symmetrical triangle pattern. The pattern could be mature enough to break soon, which would lead it to exit the ranging market and potentially extend the previous surge. The upper boundary is currently strengthened by a Bollinger Band and weekly Pivot Point at 4.4302/12 and a break above this level would likely lead to a retracement, possibly from 4.4343. Further upside risk lies at 4.4428/4440 and then 4.4544 – an area unconquered since July. A surge is supported by a green cloud right below at 4.4259 and elevated by 100 and 55-hour SMAs lying inside of it.

The one and a half month surge proved too much for EUR/PLN, leading to a consolidation inside a symmetrical triangle pattern. The pattern could be mature enough to break soon, which would lead it to exit the ranging market and potentially extend the previous surge. The upper boundary is currently strengthened by a Bollinger Band and weekly Pivot Point at 4.4302/12 and a break above this level would likely lead to a retracement, possibly from 4.4343. Further upside risk lies at 4.4428/4440 and then 4.4544 – an area unconquered since July. A surge is supported by a green cloud right below at 4.4259 and elevated by 100 and 55-hour SMAs lying inside of it.

Tue, 29 Nov 2016 08:51:27 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.