Note: This section contains information in English only.

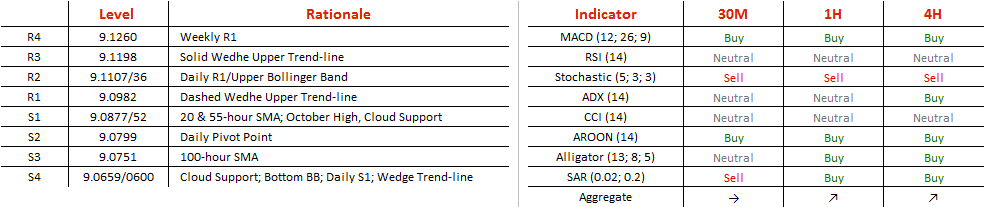

EUR/NOK sellers built up some momentum, as highs became lower in a rising wedge. While it appeared that the pair might turn the wedge into a channel up pattern, the recent wave lost amplitude on the upside, causing a premature slip targeting the bottom trend-line at 9.0648. Although it might be a case where the pair tests 9.0856, the October high and then launches a new and ultimately successful attack at the solid upper trend-line at 9.1226 as it has in previous occasions, it might be time to exit the ambiguous pattern with a break below 9.0628, the only definite trend-line, shifting risk to 9.0477, the 200-hour SMA at first. On a larger scale, however, EUR/NOK follows a channel down on the daily chart, and is currently on a wave up, meaning, that the reversal, if executed, could be unsustainable.

EUR/NOK sellers built up some momentum, as highs became lower in a rising wedge. While it appeared that the pair might turn the wedge into a channel up pattern, the recent wave lost amplitude on the upside, causing a premature slip targeting the bottom trend-line at 9.0648. Although it might be a case where the pair tests 9.0856, the October high and then launches a new and ultimately successful attack at the solid upper trend-line at 9.1226 as it has in previous occasions, it might be time to exit the ambiguous pattern with a break below 9.0628, the only definite trend-line, shifting risk to 9.0477, the 200-hour SMA at first. On a larger scale, however, EUR/NOK follows a channel down on the daily chart, and is currently on a wave up, meaning, that the reversal, if executed, could be unsustainable.

Fri, 04 Nov 2016 08:08:34 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.