Note: This section contains information in English only.

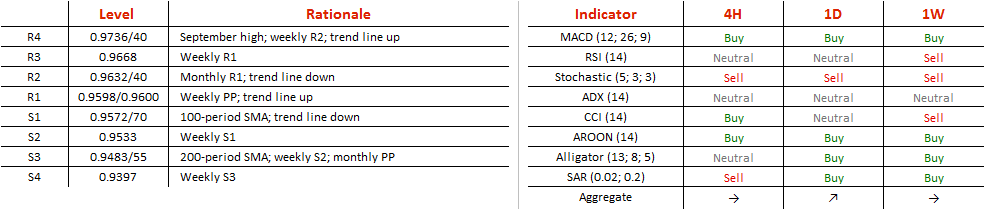

The Kiwi is depreciating against the Loonie in a descending channel pattern, which has formed due to the currency pair bouncing off a resistance of a channel up pattern, in which the rate had been since the middle of August. The most interesting detail about this currency exchange rate is that the channel up pattern has been recently broken in the downwards movement in accordance with the descending channel. With that a new yearly high has been marked, and it is possible to use Fibonacci retracements for analysis. The 61.80% Fibo at 0.9301 is the level, which provided support when the Canadian Dollar already attempted to appreciate against the New Zealand Dollar in the middle of August. At the moment, the previously mentioned retracement is most likely the goal of the rate. However, the fall might be stopped by the 200-period SMA at 0.9483.

The Kiwi is depreciating against the Loonie in a descending channel pattern, which has formed due to the currency pair bouncing off a resistance of a channel up pattern, in which the rate had been since the middle of August. The most interesting detail about this currency exchange rate is that the channel up pattern has been recently broken in the downwards movement in accordance with the descending channel. With that a new yearly high has been marked, and it is possible to use Fibonacci retracements for analysis. The 61.80% Fibo at 0.9301 is the level, which provided support when the Canadian Dollar already attempted to appreciate against the New Zealand Dollar in the middle of August. At the moment, the previously mentioned retracement is most likely the goal of the rate. However, the fall might be stopped by the 200-period SMA at 0.9483.

Thu, 22 Sep 2016 07:12:07 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.