Note: This section contains information in English only.

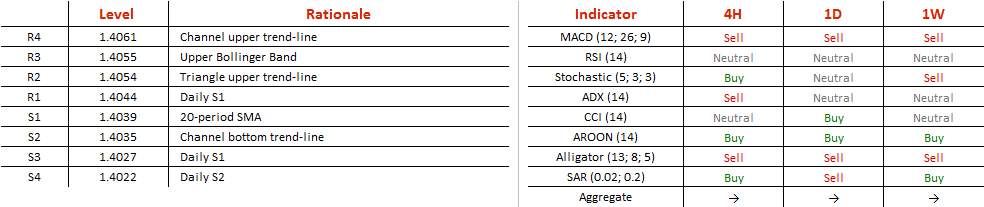

The ascending channel CHF/SGD has developed shows no signs of weakness, suggesting that the uptrend will continue. The 200-period SMA has crawled underneath for the first time in two weeks, putting further pressure onto the currency pair. We expect a dip towards the lower channel trend-line at 1.3855 over the next couple of days, before inching higher inside the bounds of the channel. A bullish development is also supported by the multi-year triangle that the rate has been following, implying that the 1.4500 area will cause the pair quite a struggle even if the channel is not broken. In case September brings an unexpected revisit of the triangle bottom trend-line, the lower channel trend-line will be broken just before a dip to 1.3770. The Golden Cross formation for 55-hour and 200-hour moving averages, as well as a 23% net oversold Frank, however, makes us to remain in favour of a distinct uptrend.

The ascending channel CHF/SGD has developed shows no signs of weakness, suggesting that the uptrend will continue. The 200-period SMA has crawled underneath for the first time in two weeks, putting further pressure onto the currency pair. We expect a dip towards the lower channel trend-line at 1.3855 over the next couple of days, before inching higher inside the bounds of the channel. A bullish development is also supported by the multi-year triangle that the rate has been following, implying that the 1.4500 area will cause the pair quite a struggle even if the channel is not broken. In case September brings an unexpected revisit of the triangle bottom trend-line, the lower channel trend-line will be broken just before a dip to 1.3770. The Golden Cross formation for 55-hour and 200-hour moving averages, as well as a 23% net oversold Frank, however, makes us to remain in favour of a distinct uptrend.

Thu, 08 Sep 2016 07:09:49 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.