Note: This section contains information in English only.

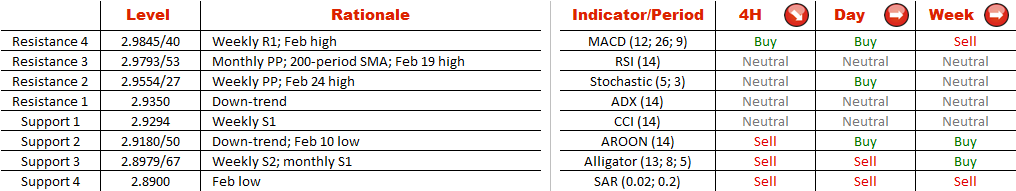

USD/TRY has recently pierced through the rising support line and confirmed it, which is a strong ‘sell' signal. Nevertheless, there is still a possibility of a rally next week. The currency pair has formed a falling wedge, meaning that demand is building up. The upside, however, is limited. In case of a close above 2.9350, the first target will be a combination of the weekly PP and Feb 24 high at 2.9527. From there the price might launch an attack on the 2.9850/2.9750 area, but should be stopped there, considering that among others the zone is formed by the monthly PP, February high, and 200-period SMA. At the same time, the US Dollar is oversold—72% of positions are short.

USD/TRY has recently pierced through the rising support line and confirmed it, which is a strong ‘sell' signal. Nevertheless, there is still a possibility of a rally next week. The currency pair has formed a falling wedge, meaning that demand is building up. The upside, however, is limited. In case of a close above 2.9350, the first target will be a combination of the weekly PP and Feb 24 high at 2.9527. From there the price might launch an attack on the 2.9850/2.9750 area, but should be stopped there, considering that among others the zone is formed by the monthly PP, February high, and 200-period SMA. At the same time, the US Dollar is oversold—72% of positions are short.

Fri, 26 Feb 2016 06:22:07 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.