Note: This section contains information in English only.

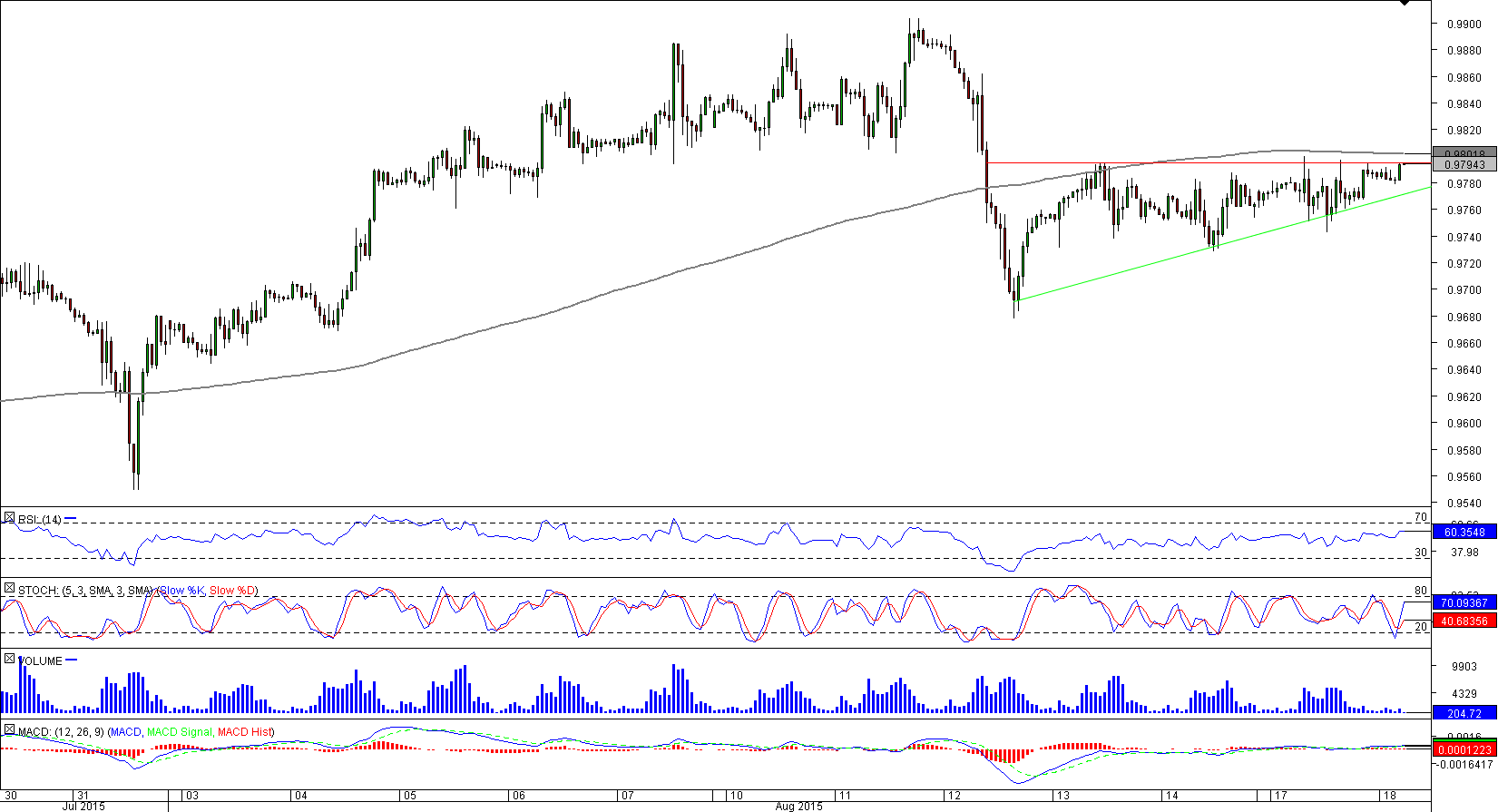

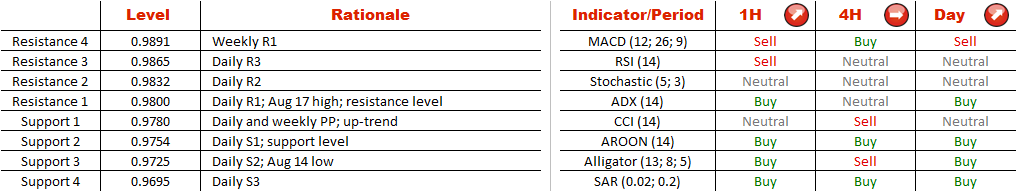

Because of the contradicting signals it is a thankless task to try to predict direction of a break-out. On the one side, an ascending triangle indicates growing demand, and the studies are bullish. On the other side, USD/CHF is currently consolidating after a strong sell-off, which resulted in a breach of the long-term SMA. However, we know the height of the pattern (120 pips), meaning in case of a close above 0.98 there is likely to be a rally towards the August high at 0.99. Alternatively, if the green up-trend is violated, there is likely to be a decline down to the weekly S1 at 0.9666. As for the sentiment of the SWFX market, the traders are mostly bearish: 72% of positions are short.

Because of the contradicting signals it is a thankless task to try to predict direction of a break-out. On the one side, an ascending triangle indicates growing demand, and the studies are bullish. On the other side, USD/CHF is currently consolidating after a strong sell-off, which resulted in a breach of the long-term SMA. However, we know the height of the pattern (120 pips), meaning in case of a close above 0.98 there is likely to be a rally towards the August high at 0.99. Alternatively, if the green up-trend is violated, there is likely to be a decline down to the weekly S1 at 0.9666. As for the sentiment of the SWFX market, the traders are mostly bearish: 72% of positions are short.

Tue, 18 Aug 2015 06:20:48 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.