Note: This section contains information in English only.

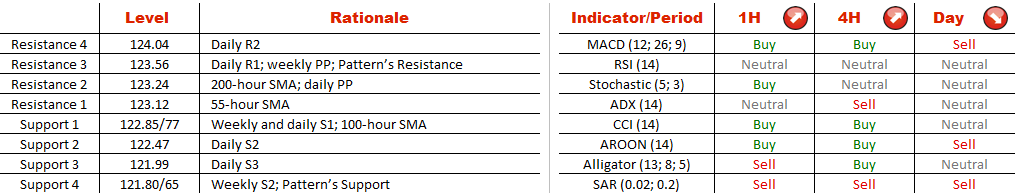

The end of May and the first week of June were exceptionally positive for the US Dollar, which rallied against the Japanese Yen, crossed the 2007 high and hit this year's maximum at 125.85. However, now the correction is taking place; therefore, the cross has formed a bearish channel pattern. In the long run some weakness is likely to persist and the pair should respect the pattern's boundaries, currently at 123.63 and 121.65. The pair is also expected to tumble in the direction of the lower edge in the next 24 hours, as this scenario is considered by the daily technical indicators. At the same time, the majority (69%) of SWFX traders still favour an appreciation of the Greenback against the Yen.

The end of May and the first week of June were exceptionally positive for the US Dollar, which rallied against the Japanese Yen, crossed the 2007 high and hit this year's maximum at 125.85. However, now the correction is taking place; therefore, the cross has formed a bearish channel pattern. In the long run some weakness is likely to persist and the pair should respect the pattern's boundaries, currently at 123.63 and 121.65. The pair is also expected to tumble in the direction of the lower edge in the next 24 hours, as this scenario is considered by the daily technical indicators. At the same time, the majority (69%) of SWFX traders still favour an appreciation of the Greenback against the Yen.

Fri, 03 Jul 2015 13:23:05 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.