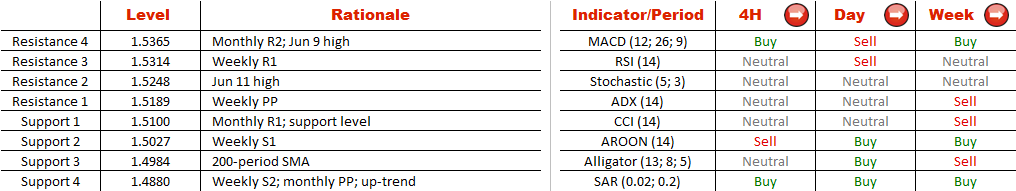

In the meantime, the technical indicators are either neutral or mixed, but most of the SWFX traders expect to profit from Euro's appreciation. Right now as many as 70% of open positions are long.

Note: This section contains information in English only.

The bullish pattern is rather a part of an upward correction following the Dec-Apr sell-off, but we can still expect an up-leg to 1.5550, namely to the Feb high. During the next several days or perhaps even weeks EUR/SGD is likely to decline to the lower edge of the pattern, but around 1.49 the Euro should bottom out and then rebound. For this to happen we first need a close below a dense demand area at 1.51, formed by the monthly R1 and some of the recent lows.

The bullish pattern is rather a part of an upward correction following the Dec-Apr sell-off, but we can still expect an up-leg to 1.5550, namely to the Feb high. During the next several days or perhaps even weeks EUR/SGD is likely to decline to the lower edge of the pattern, but around 1.49 the Euro should bottom out and then rebound. For this to happen we first need a close below a dense demand area at 1.51, formed by the monthly R1 and some of the recent lows.

In the meantime, the technical indicators are either neutral or mixed, but most of the SWFX traders expect to profit from Euro's appreciation. Right now as many as 70% of open positions are long.

Thu, 18 Jun 2015 06:39:46 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

In the meantime, the technical indicators are either neutral or mixed, but most of the SWFX traders expect to profit from Euro's appreciation. Right now as many as 70% of open positions are long.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.