Note: This section contains information in English only.

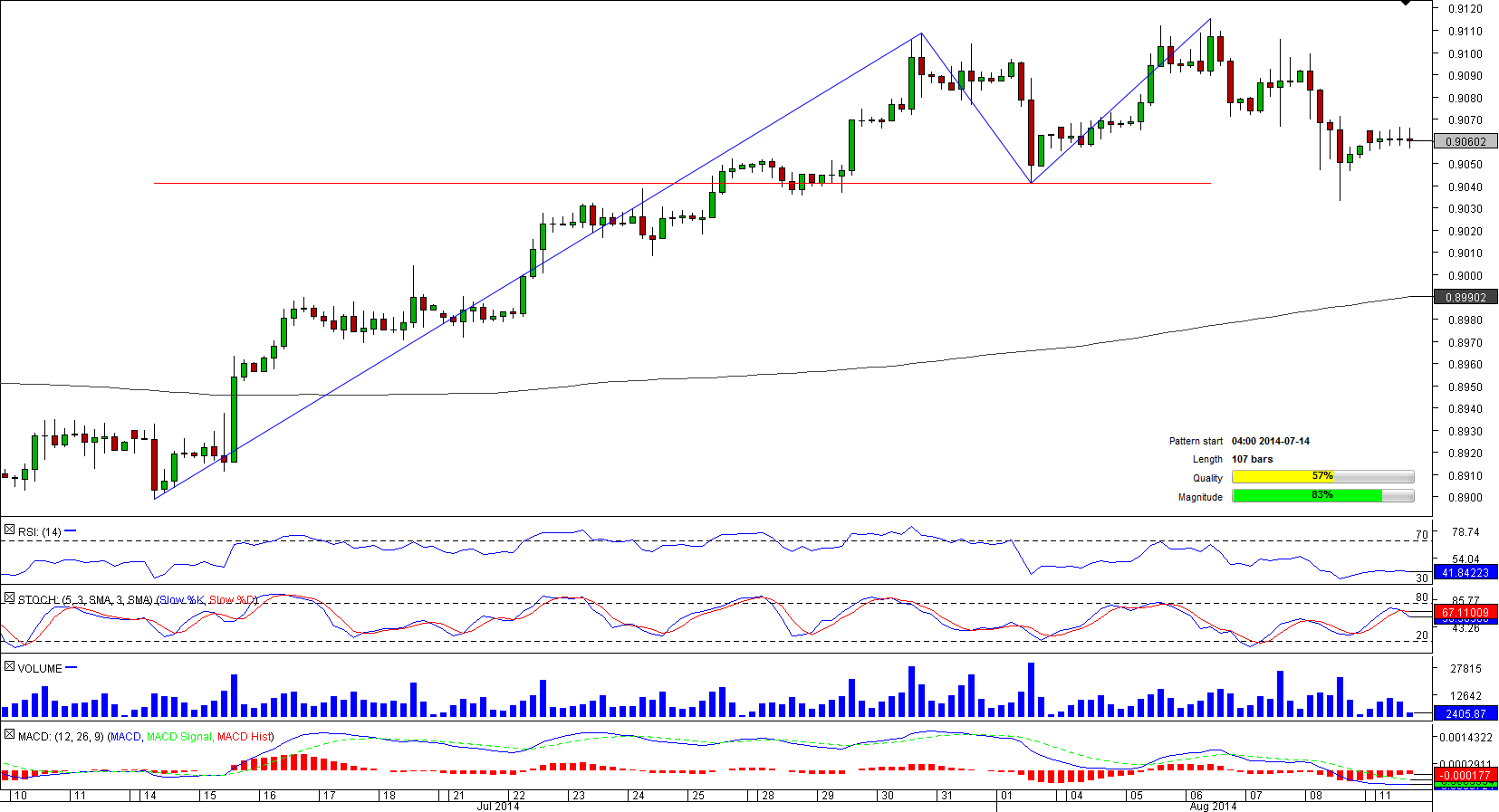

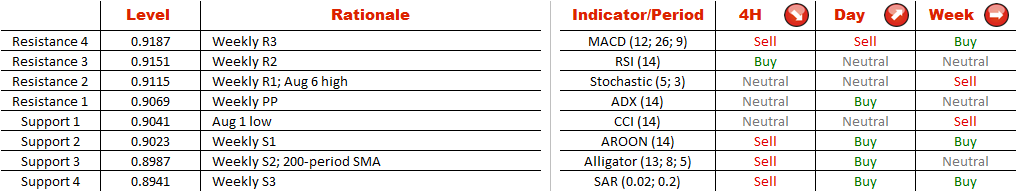

It seems the rally that was started in mid-July has finally come to an end, being that there are two distinct tops on the four-hour chart of USD/CHF. Since this is a reversal pattern, a breach of the neck-line at 0.9041 will be a distinctly bearish sign, and the ensuing dip may potentially extend down to 0.89. At the same time a combination of the weekly S2 and 200-period SMA at 0.8987 could be a good intermediary target.

It seems the rally that was started in mid-July has finally come to an end, being that there are two distinct tops on the four-hour chart of USD/CHF. Since this is a reversal pattern, a breach of the neck-line at 0.9041 will be a distinctly bearish sign, and the ensuing dip may potentially extend down to 0.89. At the same time a combination of the weekly S2 and 200-period SMA at 0.8987 could be a good intermediary target.

Mon, 11 Aug 2014 13:48:08 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

However, the SWFX market participants are largely bullish with respect to USD/CHF (71% of positions are long) and apparently do not see the resistance at 0.91 as a serious threat to the bullish momentum.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.