Technical indicators on aggregate point at depreciation of the pair on 1H horizon. The SWFX market sentiment shows that 63% of traders currently are holding short positions of the pair expecting depreciating of the pair as well. Short traders should focus on the daily pivot (PP) at 1.5706. If this level is breached, next targets could be at 200 day SM/daily pivot (S1)/pattern's support at 1.5667 and daily pivot (S2) at 1.5591.

Note: This section contains information in English only.

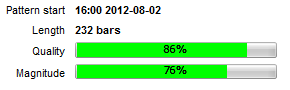

GBP/USD is recovering and has formed a Rising Wedge pattern on the 4H chart. The pattern has 86% quality and 76% magnitude in the 339-bar period.

GBP/USD is recovering and has formed a Rising Wedge pattern on the 4H chart. The pattern has 86% quality and 76% magnitude in the 339-bar period.

Technical indicators on aggregate point at depreciation of the pair on 1H horizon. The SWFX market sentiment shows that 63% of traders currently are holding short positions of the pair expecting depreciating of the pair as well. Short traders should focus on the daily pivot (PP) at 1.5706. If this level is breached, next targets could be at 200 day SM/daily pivot (S1)/pattern's support at 1.5667 and daily pivot (S2) at 1.5591.

Fri, 17 Aug 2012 13:08:20 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

The pattern started when the pair bounced from 1.5491 and after testing pattern's support twice it slowed down at 1.5715 where the pair is currently trading. Long traders, who expect that the pair will continue to follow pattern upward trend, could set the targets at the pattern's resistance at 1.5759 and daily pivot (R1) at 1.5775.

Technical indicators on aggregate point at depreciation of the pair on 1H horizon. The SWFX market sentiment shows that 63% of traders currently are holding short positions of the pair expecting depreciating of the pair as well. Short traders should focus on the daily pivot (PP) at 1.5706. If this level is breached, next targets could be at 200 day SM/daily pivot (S1)/pattern's support at 1.5667 and daily pivot (S2) at 1.5591.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.