Technical indicators on aggregate point at depreciation of the pair on 1H outlook indicating that the pair will continue to move towards pattern's support band. Short traders should focus on the daily pivot at 95.795. If this level is breached, next target could be at the pattern's support at 95.645.

Note: This section contains information in English only.

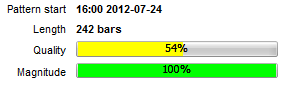

EUR/JPY is continuing to slowly appreciate an has formed a Channel Up pattern on the 1H chart. The pattern has 54% quality and 100% magnitude in the 242-bar period.

EUR/JPY is continuing to slowly appreciate an has formed a Channel Up pattern on the 1H chart. The pattern has 54% quality and 100% magnitude in the 242-bar period.

Technical indicators on aggregate point at depreciation of the pair on 1H outlook indicating that the pair will continue to move towards pattern's support band. Short traders should focus on the daily pivot at 95.795. If this level is breached, next target could be at the pattern's support at 95.645.

Fri, 10 Aug 2012 13:14:26 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

The pattern started when the pair bounced from 91.125 and after testing pattern's resistance twice it slowed down at 95.921 where the pair is currently trading. The stochastic indicator on 4H time horizon points at appreciation of the pair indicating we should see some price correction in the near future. The SWFX market sentiments shows that two thirds of traders expect appreciation of the pair as well. Long traders could set the first target at the Fibonacci retracement (50%) at 95.9740. If this level is breached, next targets could be at the daily pivot at 96.2083 Fibonacci retracement (61.8%) at 96.411 and SMA200 at 96.569.

Technical indicators on aggregate point at depreciation of the pair on 1H outlook indicating that the pair will continue to move towards pattern's support band. Short traders should focus on the daily pivot at 95.795. If this level is breached, next target could be at the pattern's support at 95.645.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.