Traders' Sentiment

Note: This section contains information in English only.

"The nonfarm payrolls number gives considerable political capital for the U.S. Federal Reserve to announce further QE"

"The nonfarm payrolls number gives considerable political capital for the U.S. Federal Reserve to announce further QE"

Traders' Sentiment

Mon, 04 Jun 2012 07:11:47 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Faros Trading in Stamford (based on CNBC)

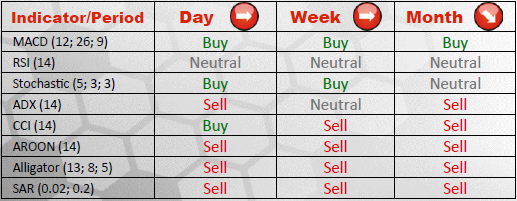

Pair's Outlook

EUR/USD is currently consolidating ahead of a support 1.2266/49, which should be able to limit possible near-term losses of the pair. Rallies, on the other hand, should be tepid, since a tough resistance level at 1.2585 will cap the price for now. In the long run, however, the currency couple is expected to maintain its southwards direction, until 1.16 is attained.

Traders' Sentiment

SWFX marketplace traders' sentiment towards EUR/USD is presently mixed, as 51% of all the positions on the currency pair are long and 49% of them are short. As for the orders placed, buy orders are in majority, constituting 57% of all the commands, while the portion of sell orders is 43%. Nonetheless, the common currency remains the most popular among its peers.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.