Traders' Sentiment

Note: This section contains information in English only.

"You can't relax your guard as concerns remain over the problem in Spain. There still is a good likelihood that the euro will fall to test the $1.20 mark"

"You can't relax your guard as concerns remain over the problem in Spain. There still is a good likelihood that the euro will fall to test the $1.20 mark"

Traders' Sentiment

Mon, 28 May 2012 06:55:57 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Mizuho Corporate Bank (based on WSJ)

Pair's Outlook

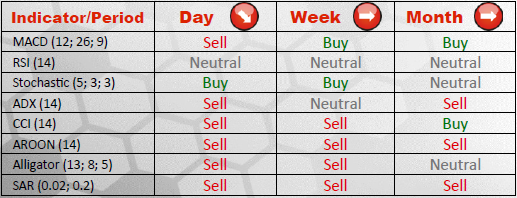

A tough support located at 1.2509 has managed to repel attack of the price, but bearish bias persists and has not yet vanished, as indicated by MACD and five alternative studies. Current rally of EUR/USD should be limited by resistance areas situated at 1.2628/42 and at 1.2761/1.2828, implying the currency couple will refocus supports after encountering these zones.

Traders' Sentiment

According to SWFX marketplace participants' sentiment, the European currency is the most popular currency at the moment among its main counterparts. Consequently, majority (62%) of opened positions on EUR/USD is long, whereas 38% of them are currently short. However, the situation is reversed with respect to the orders placed, as only 32% of them are to acquire the Euro and the rest (68%) are to sell it.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.