Traders' sentiment

Note: This section contains information in English only.

Industry outlook

Traders' sentiment

Fri, 30 Mar 2012 11:51:24 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank

"The euro has been on a firm footing. Should European finance ministers agree to beef up the rescue fund, the euro may get a bit firmer."

- Mizuho Securities Co. (based on Bloomberg)

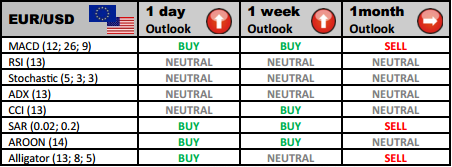

The pair remains pretty resilient after the S&P announcement Greece might require another bailout package to restructure its debt and is capable of approaching the recent high at 1.3449. Inability to move higher would switch focus of the market to the 1.3210/1.3174 area (55-day ma). If bearish mood intensifies, a recent low at 1.3004 might be targeted next.

Traders' sentiment

Bearish expectations incrementally loosened among the market participants compared to yesterday as the share of short orders crawled lower versus the long ones (58.17% vs. 41.83%).

Forex traders holding long positions on EUR/USD should be aware of immediate resistance at 1.3347. A strengthening bullish momentum would encounter R2 at 1.3393 and R3 at 1.3441.

Investors with short positions on the currency pair are likely to faced the immediate support line at 1.3253. In case of a breakthrough, the next levels are located at 1.3226 and 1.3175 accordingly.

© Dukascopy Bank

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.