© Dukascopy Bank

"The U.S. economy still faces some headwinds, particularly from Europe, but the outlook is a bit more promising than it was a year ago"

- Raymond James & Associates Inc. (based on Bloomberg)

Industry outlook

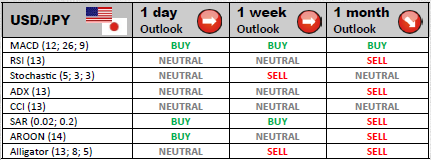

After rebounding from 76.63, USD/JPY is expected to carry on rising while encountering resistances situated at 77.50, 78.42 (200 day ma), 79.49 (55 week ma) and 80.00. At the moment the currency pair is attempting to breach through 100 day ma at 77.19.

Traders' sentiment

The ratio between the amounts of long and short trades has been little changed since Friday morning. 46% of positions are presently bullish, while the rest 54% are correspondingly bearish.

Long position opened

The initial resistance level for the pair is 77.38. If the price continues increasing, the investors will hold longs until the pair climbs up to 77.65 or 78.00.

Short position opened

Largest investors might have placed their take profit orders at the key support levels. These levels for intraday trading are situated at 76.76, 76.41 and 76.14.

© Dukascopy Bank