Note: This section contains information in English only.

Mon, 11 Nov 2013 16:02:48 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

"A surprisingly strong US payrolls report pushed US interest rates and the US dollar sharply higher. October saw 204,000 jobs added, versus 120,000 expected, and there were positive back revisions. This caused the market to reassess the timing for Fed tapering, some expecting it could be as early as December."

- Westpac Bank (based on The New Zealand Herald)

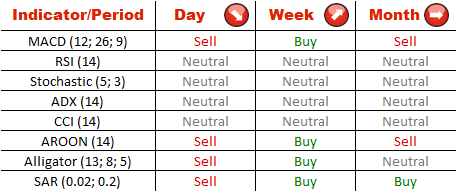

Pair seems to be rather turbulent around 0.825. It is not demonstrating willingness to fall lower, but is not capable of advancing higher either. It might be it will be range bound between 0.8296 and 0.8196 for a good part of the week. Mixed readings from short and medium term technicals give support for that. Dip or peak below or above any of these levels could ignite a major move outside the boundaries of indicated levels.

Bears are holding tight grip on the market as they continue to hold overwhelming majority (71%) of all open positions on the pair. In addition to this, bearish side of pending orders increased by 17% and is at 54% gauge today.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.