Traders' Sentiment

Note: This section contains information in English only.

"There's been a burst of optimism on the announcement the ruling will not be delayed, but this move looks a bit extreme on the basis it's just confirmation it will be delivered on time."

"There's been a burst of optimism on the announcement the ruling will not be delayed, but this move looks a bit extreme on the basis it's just confirmation it will be delivered on time."

Traders' Sentiment

Tue, 11 Sep 2012 15:07:43 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

-BNP Paribas (based on Reuters)

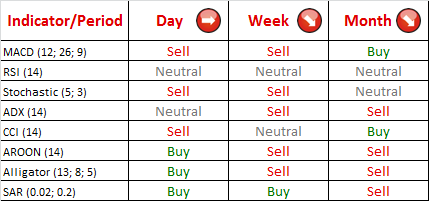

Pair's Outlook

Pair is continuing to hover depressed below 100. Technical indicators on 1 day and 1 week charts and cluster of resistance levels slightly above 100 suggest that pair will be pushed down, maybe even below 99 since the only support level on the way would be weekly PP at 99.501. However, amount of pending orders suggest that if pair would manage to breach 100 mark we will see a sharp appreciation of the pair.

Traders' Sentiment

Pairs sentiment is slightly bullish for the second day in a row as 52% of traders hold long positions on the pair. However, it is very likely we will see a major strengthening in traders sentiment since 72% of all pending orders are buy orders.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.