Traders' Sentiment

Note: This section contains information in English only.

"The euro is going to stay quite weak, particularly against the U.S. dollar and the yen. The euro zone is still in recession and it's probably getting even deeper"

"The euro is going to stay quite weak, particularly against the U.S. dollar and the yen. The euro zone is still in recession and it's probably getting even deeper"

Traders' Sentiment

Tue, 10 Jul 2012 07:13:26 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Commonwealth Bank of Australia (based on Bloomberg)

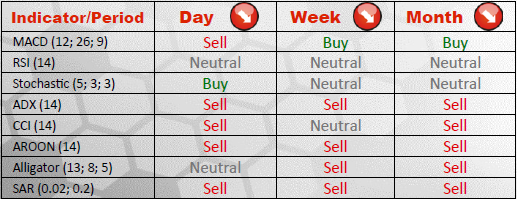

Pair's Outlook

Recovery of EUR/USD yesterday did not live up to expectations, as it seized to exist far from 1.2386/97, but was still present. At the moment the currency pair is heading towards 1.2128/06, though it will have to breach an initial level located at 1.2240 first. Moreover, given current outlook and signals of most of indicators, the price is likely to extend losses down to 1.1986/26.

Traders' Sentiment

The share of bullish towards EUR/USD market participants remains unchanged at 61%, while bearish traders continue to constitute 39% of the market, since the single European currency is the most popular among its major counterparts. However, the expected rally is likely to be shallow, since only 38% of orders are to buy the Euro, the rest of them (62%) are to sell it.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.