Traders' Sentiment

Note: This section contains information in English only.

"With U.S. dollar/yen comfortably far enough away from intervention levels, this pair ‘should' continue provide the most predictable response, i.e., weak data should help U.S. dollar/Japanese yen lower and vice versa"

"With U.S. dollar/yen comfortably far enough away from intervention levels, this pair ‘should' continue provide the most predictable response, i.e., weak data should help U.S. dollar/Japanese yen lower and vice versa"

Traders' Sentiment

Fri, 06 Jul 2012 07:38:11 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- RBC Capital (based on MarketWatch)

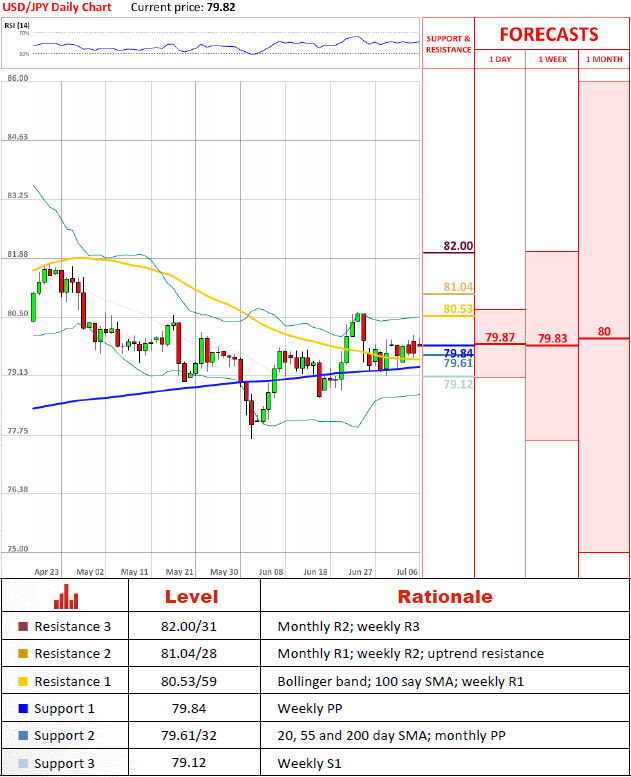

Pair's Outlook

USD/JPY remains calm despite other currency pairs being under considerable stress. The pair has formed a base above 79.84 and is likely to preserve its from neutral to bullish outlook, as a key support at 79.61/34 managed to withstand the pressure and approve its significance to the market. Resistances to be targeted in future are at 80.53/59 and 81.04/28.

Traders' Sentiment

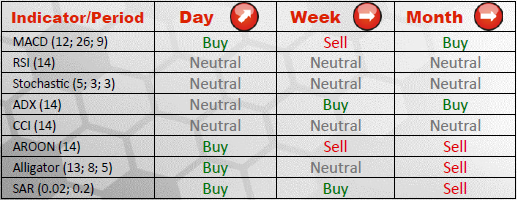

Since the Japanese Yen is the least preferred currency in the market, being bought in 27% of cases in general, traders' sentiment is bullish to a large extent, namely 73%, towards USD/JPY, as they expect the Asian currency to continue depreciating. The similar advantage have buy orders over sell orders, being that their portion is 74% compared to a 26% share of the counterparts.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Pre viac informácií o Dukascopy Bank CFD / Forex obchodných platformách a ostatných záležitostiach

nás prosím kontaktujte alebo požiadajte o hovor od nás.

nás prosím kontaktujte alebo požiadajte o hovor od nás.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.