-

JCloud integration

-

Chart replay mode

-

Order management on breaks

-

Position reverse / double

-

New order types

Use all the advantages of the modern mobile trading by keeping pace with the rapid changes in the financial market with the JForex mobile platform, designed for better flexibility and constant control — Swiss Forex Bank in your pocket.

Read about JForex Mobile

Experience no limits while trading on SWFX with JForex Web 3 platform optimized for quick access and lower technical requirements, thus remaining accessible from various devices — no worries, the workspace will be saved on JCloud.

Read about JForex Web 3

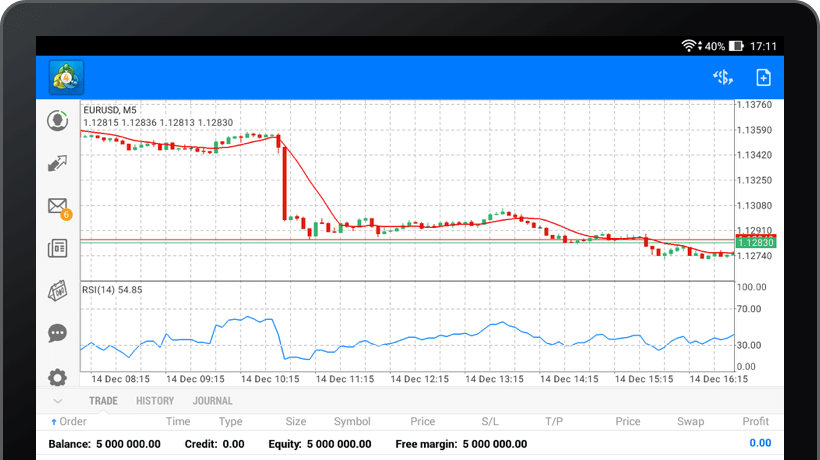

Trade via MetaTrader 4 — a well-known trading platform, appreciated by many traders around the world. No need for third-party bridges anymore, now you can use a direct connection to SWFX Swiss Marketplace provided by Dukascopy.

Stay flexible anytime and everywhere with MetaTrader 4 application, which allows trading on financial market via iOS and Android powered mobile devices and get benefits from being a client of the regulated Swiss bank.

Read about MetaTrader 4 for mobile

The MetaTrader 5 is a well-known and widely-used platform, which is equipped with advanced automated strategy features and many other sophisticated functionalities. Dukascopy aims to provide its clients with the most popular trading solutions in the market.

The Binary Desktop Platform is the full-featured desktop solution for trading binary options with Dukascopy. Efficient simplicity meant to provide convenient trading experience is the key idea behind the Binary Desktop Platform. Optimized for usage intuitivity, yet customizable for trader's individual interface preferences.

Read about Binary Desktop Platform

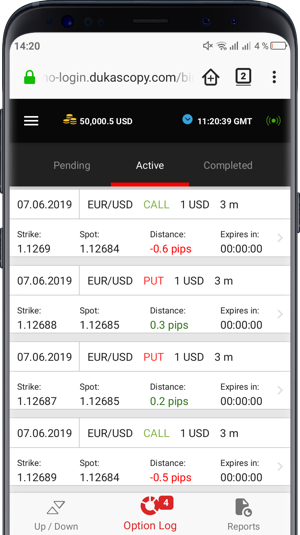

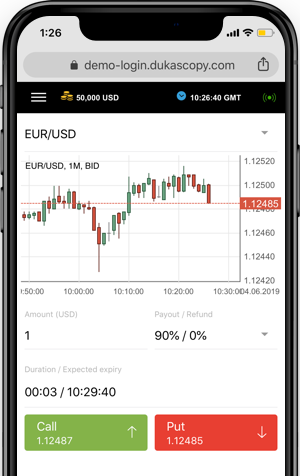

Binary Mobile Platform brings options to your mobile device. The sleek and functional interface provides a great trading experience. The platform is optimized for usage in mobile browsers and offers just the right tools, including convenient charts, detailed logs and reports.

Read about Binary Mobile Platform