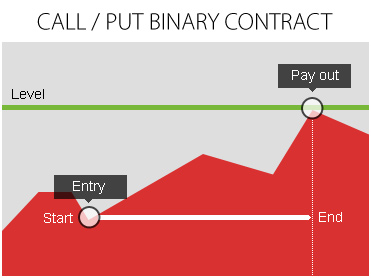

Bank Dukascopy koncentruje się na najbardziej popularnym i najprostszym rodzaju opcji binarnych, które powszechnie określane są jako kontrakty binarne "Up/Down" lub "Call/Put".

W przypadku opcji binarnych Call/Put trader określa, czy cena instrumentu bazowego w momencie wygaśnięcia kontraktu będzie wyższa czy niższa od ceny na początku kontraktu.

Jedyną rzeczą, która decyduje o możliwych zyskach z opcji Call/Put binarnych, jest cena w momencie wygaśnięcia kontraktu opcyjnego.

- Jeśli prognoza tradera jest prawidłowa, opcja jest In-the-money, a trader otrzymuje z powrotem zapłaconą premię oraz kwotę równą odpowiedniemu wskaźnikowi wypłaty (między 70% a 90%) pomnożoną przez kwotę premii.

- Jeśli prognoza tradera jest nieprawidłowa, co oznacza, że cena rynkowa w momencie wygaśnięcia opcji jest niższa od ceny wykonania dla opcji typu Up/Call (lub wyższa dla opcji typu Down/Put), kontrakt uznawany jest za Out-of-the-money. W takim przypadku trader nie osiąga żadnego zysku i traci zapłaconą premię.

Zwykle zyski wypłacane za transakcje in-the-money zależą od instrumentu bazowego oraz stawki zwrotu (wskaźnika wypłaty), jaką broker jest skłonny zaoferować. Podejście banku Dukascopy polega na oferowaniu jednolitego wskaźnika wypłaty dla całego zakresu instrumentów handlowych (zobacz warunki, aby uzyskać więcej szczegółów).

Przykład 1

- Scenariusz: Trader uważa, że euro wzmocni się w stosunku do dolara amerykańskiego (EUR/USD wzrośnie).

- Działanie: Decyduje się otworzyć kontrakt opcji binarnej z opcją kupna na EUR/USD z inwestycją wynoszącą $100, czasem wygaśnięcia 2 godziny oraz stawką wypłaty/zwrotu wynoszącą 90%/0%.

- Cena wykonania: Opcja kupna jest otwierana po cenie ASK wynoszącej 1,2000.

- Wypłata: Jeśli prognoza tradera jest prawidłowa, a cena BID dla EUR/USD wynosi powyżej 1,2000 w momencie wygaśnięcia, otrzymuje wypłatę w wysokości $90 (tj. $100 x 90%) oraz pełny zwrot zainwestowanej kwoty.

- Strata: Jeśli prognoza tradera okaże się błędna, a cena BID dla EUR/USD będzie wynosić poniżej lub równo 1,2000 w momencie wygaśnięcia, trader traci całą swoją inwestycję, ponieważ zwrot wynosi 0%.

Przykład 2

- Scenariusz: Trader oczekuje, że funt brytyjski osłabi się w stosunku do jena japońskiego (GBP/JPY spadnie).

- Działanie: Decyduje się otworzyć kontrakt opcji binarnej z opcją sprzedaży na GBP/JPY z inwestycją wynoszącą $100, czasem wygaśnięcia 30 minut oraz stawką wypłaty/zwrotu wynoszącą 70%/20%.

- Cena wykonania: Opcja sprzedaży jest otwierana po cenie BID wynoszącej 140,00.

- Wypłata: Jeśli prognoza tradera jest trafna, a cena ASK dla GBP/JPY wynosi poniżej 140,00 w momencie wygaśnięcia, otrzymasz wypłatę w wysokości $70 (tj. $100 x 70%) oraz zapłaconą premię.

- Strata: Jeśli prognoza tradera okaże się błędna, a cena ASK dla GBP/JPY będzie wynosić 140,00 lub więcej w momencie wygaśnięcia, trader otrzyma zwrot w wysokości 20% swojej inwestycji (w tym przypadku $20) i straci resztę.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.