Dukascopy Europe's Overnight Policy is aimed at providing highly competitive rollover conditions to its clients in order to underline the Bank's leadership in the FX industry. Dukascopy Europe applies different rollover rates to ensure that higher trading turnover for a client results in better overnight conditions.

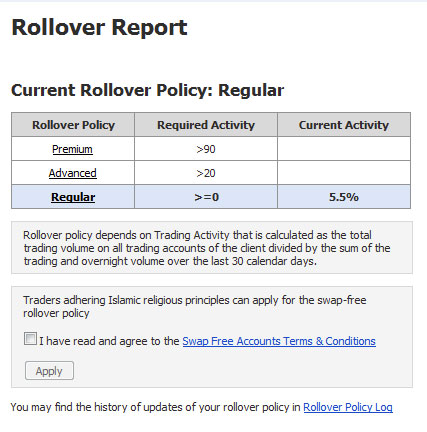

The rollover policy of the client trading accounts is determined dynamically by the trading activity level (Trading Activity). Trading Activity is calculated as the total trading volume on all trading accounts of the client divided by the sum of the trading and overnight volume over the last 30 calendar days.

- *The sum of all executed orders except for rollover trades.

- **The sum of rollover open trades.

Trading Activity reflects the trader's tendency to trade intraday more frequently than to keep positions overnight. Trading Activity is recalculated on a daily basis at the settlement time and the rollover policy is defined according to the percentage levels below:

| Rollover Policy | Required Trading Activity |

|---|---|

| Premium | > 90% |

| Advanced | > 20% |

| Regular | ≤ 20% |

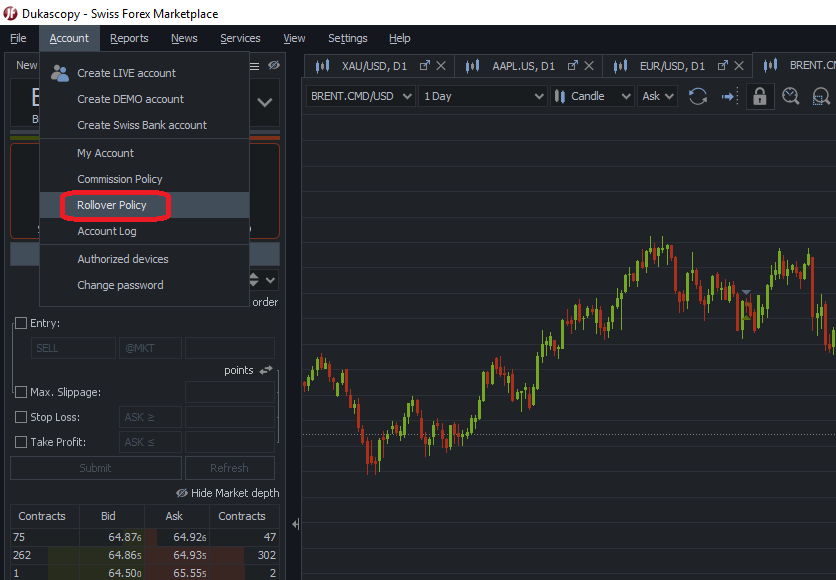

Advanced Rollover Policy is used by default in case of the absence of trading statistics over the last 30 days and it is provided as a target level which ensures attractive rollover rates for customers. Meanwhile, traders with a higher trading activity above 90% can benefit from premium swap rates. Clients are able to view the rollover policy applied to their accounts in the report called "Rollovers". For more information about Trading Activity, see the examples below.

-

Example 1

Over the last 30 calendar days, a trader opens 6 positions of 1 million, closes 5 positions the same day, and keeps 1 position overnight.

Opening trade volume 6'000'000 Partial closing trade volume 5'000'000 Rollover open volume for 1 day 1'000'000 Total trading volume 11'000'000 Total trading and overnight volume 12'000'000 Trading Activity: 11'000'000 / 12'000'000 * 100% = 92%

Applicable rollover policy: PremiumExample 2

Over the last 30 calendar days, a trader opens a position of 1 million and keeps it for 9 days before it is closed.

Opening trade volume 1'000'000 Closing trade volume 1'000'000 Rollover open volume for 9 day 9'000'000 Total trading volume 2'000'000 Total trading and overnight volume 11'000'000 Trading Activity: 2'000'000 / 11'000'000 * 100% = 18%

Applicable rollover policy: Regular

Please beware that on certain calendar days, multiple swaps must be applied and that consequently, your own calculation of applicable swap points may differ from swap points charged or credited to your account. If in doubt, please contact the Trading Support Desk.

Rollover Procedure

The overnight procedure describes the daily process of rollover, in order to adjust any existing exposure to the new trading day. The process is also known as "position roll", "carry" or "overnight swap"; it is needed to avoid full cash delivery and receipt of the currencies traded. The end-of-day settlement process is done at 21:00/22:00 GMT (depending on the summer/winter season). A pair of rollover trades is booked for each open position, as the existing positions are closed for the past trading day at the settlement price and simultaneously re-opened for the new trading day at the settlement price +/- the applicable overnight adjustment in pips as seen in the table. These trades are labeled as "rollover close" and "rollover open" respectively and can be viewed in portfolio and intraday statements. In addition, clients can see the impact of the carry in the position report.

Rollover Updates

Overnight swap prices are commonly based on the central bank reference rates shown in the table below. Overnight swap rates change with changes in the interest rate differentials of the two currencies involved. However, Dukascopy Europe updates its own rates on the basis of interbank market overnight swaps.

Dukascopy Europe uses the following central bank target rates as a basis for its overnight policy set-up. It must be stressed that Dukascopy Europe adds its own carry costs to the rates applied to the clients.

| USD | Federal Funds Target Rate |

|---|---|

| EUR | Main Refinancing Rate |

| GBP | Official Bank Rate |

| JPY | Uncollateralized Overnight Call Rate |

| CHF | Average Repo Overnight Rate |

| CAD | Target Key Interest Rate |

| AUD | Cash Target Rate |

| NZD | Official Cash Rate |

Swap-free-accounts

Swap-free accounts are trading accounts in adherence with Islamic religious principles.

The overnight swap cost which is normally charged or credited to client accounts as price difference between rollover close and rollover open trades is not applied to swap-free accounts meaning that both rollover trades are booked at same price. The Client will not be credited nor debited any interest on any open position in their trading account with Dukascopy Europe at the closing of each business day (21:00/22:00 GMT summer/winter time).

In order to prevent abusive use of swap-free conditions and financial damage to Dukascopy, following protection measures are applied:

- In addition to the standard volume commission paid by clients, an additional fee of USD 5 per 1 million USD for currencies and USD 7.5 per 1 million USD for precious metals and CFDs is charged to swap-free accounts

- Dukascopy estimates its financial damage by calculating the difference between the additional commission paid by the client and the swap amount which is not applied to the account due to the swap-free conditions. If the difference is negative (the "Deficit") and the account equity does not fully cover the Deficit Dukascopy will block further trading by closing opened exposures and canceling active pending orders

The Deficit is calculated once a day at settlement time and is applied by adjusting the minimum Stop Loss Level.

The Deficit amount will be debited from the account if:

- the Client presses "Pay Deficit" button in Rollover Policy report

- it becomes greater than the equivalent of 5'000 USD or 10% of the account balance

- the swap-free rollover policy is terminated

- a full withdrawal is made on the account

- the account is to be charged as per maintenance fee policy

The amount of a partial withdrawal cannot exceed the difference between the account equity and the Deficit.

In case of a contradiction between the present Swap-Free Account Terms & Conditions and any other contractual arrangement between the client and Dukascopy Europe, the present Swap-Free Account Terms & Conditions shall prevail. Dukascopy Europe may change Swap-Free Account Terms & Conditions, decline or cancel the use of swap-free conditions, at its own discretion. Dukascopy reserves the right to debit the Deficit at any time.

Any self-trader may activate/cancel the swap-free conditions at any time from reports as illustrated below:

Settlement Procedure

Settlement activities are conducted on a daily basis and include all post-trade operations such as trade settlements, rollovers, volume commissions and daily P L conversions and other end-of-day amendments (please refer to Overnight policy for related information on value date and overnights). Settlement procedure is applied at 21:00/22:00 GMT and is carried out automatically in the account's base currency. The account balance is updated on a daily basis after the settlement procedure. Clients are able to track balance history in various reports through the trading platform or through web based entry.