Aggregate indicators on the 30M horizon strongly point at bearish market outbreak. Moreover, this is supported by current market sentiment which is 70% bearish. Short traders could focus on the daily support level at 0.7563. If the pair breaches this level, next possible target could be at 0.7553.

Note: This section contains information in English only.

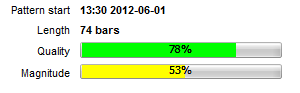

NZD/USD is slowing down after hitting the lowest level this year and has formed a Rising Wedge pattern on the 30M chart. The pattern has 78% quality and 53% magnitude in the 120-bar period.

NZD/USD is slowing down after hitting the lowest level this year and has formed a Rising Wedge pattern on the 30M chart. The pattern has 78% quality and 53% magnitude in the 120-bar period.

Aggregate indicators on the 30M horizon strongly point at bearish market outbreak. Moreover, this is supported by current market sentiment which is 70% bearish. Short traders could focus on the daily support level at 0.7563. If the pair breaches this level, next possible target could be at 0.7553.

Tue, 05 Jun 2012 06:54:58 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

The pattern started when pair rebounded from 0.7562 and after bouncing between 0.7501 and 0.7603 it has slowed down at 0.7588 where the pair is currently trading. Aggregate indicators suggest an emerging bullish trend at 4H time horizon. Long traders could focus on the resistance level at 0.7593. If this level will be breached, next target could be at a daily high at 0.7603.

Aggregate indicators on the 30M horizon strongly point at bearish market outbreak. Moreover, this is supported by current market sentiment which is 70% bearish. Short traders could focus on the daily support level at 0.7563. If the pair breaches this level, next possible target could be at 0.7553.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.