Note: This section contains information in English only.

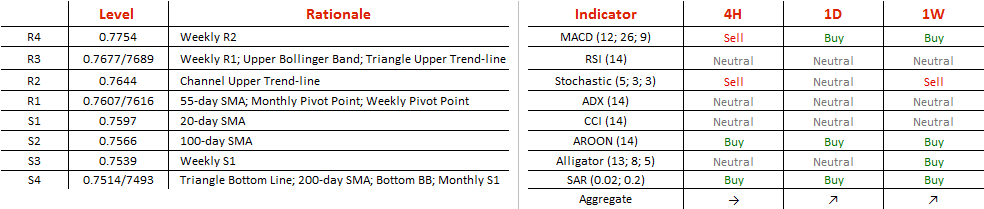

A symmetric triangle established over 2016 is signalling an extended motion north – a claim whose credibility might be overshadowed by the four and a half year channel down, which has proved dominant, breaking junior patterns before. Currently attempting the upper trend-line of the channel at 0.7649, AUD/USD is likely to bounce from the level to fall right through the triangle bottom trend-line at 0.7520. A cluster of supply pressures just above at 0.7607/16 will facilitate the movement, setting the 0.5600 area – channel bottom trend-line - as the ultimate target for the following months. In case the channel loses the battle against the current tests with inside of the triangle, we are likely to see a bounce from the 0.7783/7815 area, to consolidate 0.7474 and extend the rally towards 0.9426 or 0.9660 over 2017 and early 2018.

A symmetric triangle established over 2016 is signalling an extended motion north – a claim whose credibility might be overshadowed by the four and a half year channel down, which has proved dominant, breaking junior patterns before. Currently attempting the upper trend-line of the channel at 0.7649, AUD/USD is likely to bounce from the level to fall right through the triangle bottom trend-line at 0.7520. A cluster of supply pressures just above at 0.7607/16 will facilitate the movement, setting the 0.5600 area – channel bottom trend-line - as the ultimate target for the following months. In case the channel loses the battle against the current tests with inside of the triangle, we are likely to see a bounce from the 0.7783/7815 area, to consolidate 0.7474 and extend the rally towards 0.9426 or 0.9660 over 2017 and early 2018.

Mon, 10 Oct 2016 08:52:04 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.