Note: This section contains information in English only.

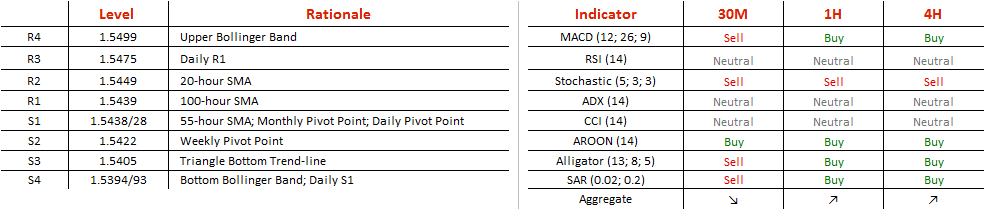

A 2.6% surge resulted in a week-long consolidation inside the bounds of a symmetrical triangle. After breaking the upper trend-line of the triangle, EUR/NZD got carried away in the rebound, dipping below the broken level at 1.5441. We are looking for a rally to come next, setting 1.5475, 1.5500 and 1.5511 as the closest levels to watch, but with risk at 1.5552, where the major supply level could let bears take over in the short-term. In case the rate closes the hour below the trend-line, demand zones at 1.5432, 1.5428 and 1.5422 could deny access to levels underneath, causing future movements to contain an uncertainty factor. While 55-hour and 100-hour SMA lie just beneath the broken trend-line, pushing the rate currently down, they do provide potential bullish pressures in case the broken line is confirmed and the rebound is completed with a bounce from the area.

A 2.6% surge resulted in a week-long consolidation inside the bounds of a symmetrical triangle. After breaking the upper trend-line of the triangle, EUR/NZD got carried away in the rebound, dipping below the broken level at 1.5441. We are looking for a rally to come next, setting 1.5475, 1.5500 and 1.5511 as the closest levels to watch, but with risk at 1.5552, where the major supply level could let bears take over in the short-term. In case the rate closes the hour below the trend-line, demand zones at 1.5432, 1.5428 and 1.5422 could deny access to levels underneath, causing future movements to contain an uncertainty factor. While 55-hour and 100-hour SMA lie just beneath the broken trend-line, pushing the rate currently down, they do provide potential bullish pressures in case the broken line is confirmed and the rebound is completed with a bounce from the area.

Fri, 30 Sep 2016 06:24:56 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.