Note: This section contains information in English only.

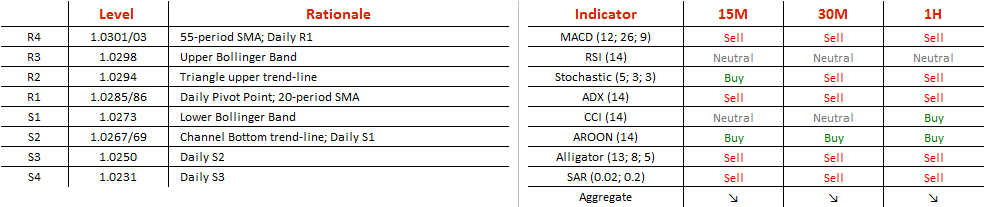

A descending triangle has kept AUD/NZD from diving right away, causing it to consolidate before dipping to April 2015 lows at 1.0035 with a few intermediate supply zones on its way. A move south will be assisted by various time-frame SMAs which will push from the upside to the critical 1.0269 level which corresponds to the lower triangle trend-line. The level is strengthened by the daily S1 right beneath at 1.0267, and a break below would trigger a dive to 1.0250, where the daily S2 lies. In case the pair does not lose strength enough to plunge out of the pattern just yet, and continues to the upper triangle trend-line instead, it will face several near-term resistances, such as 1.0285/86, where the daily Pivot Point clusters with the 20-period SMA.

A descending triangle has kept AUD/NZD from diving right away, causing it to consolidate before dipping to April 2015 lows at 1.0035 with a few intermediate supply zones on its way. A move south will be assisted by various time-frame SMAs which will push from the upside to the critical 1.0269 level which corresponds to the lower triangle trend-line. The level is strengthened by the daily S1 right beneath at 1.0267, and a break below would trigger a dive to 1.0250, where the daily S2 lies. In case the pair does not lose strength enough to plunge out of the pattern just yet, and continues to the upper triangle trend-line instead, it will face several near-term resistances, such as 1.0285/86, where the daily Pivot Point clusters with the 20-period SMA.

Tue, 13 Sep 2016 06:21:31 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.