Note: This section contains information in English only.

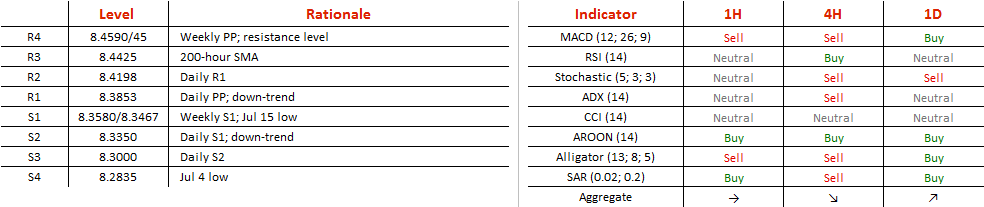

The US Dollar is set to increase in value against the Norwegian Krone. The currency pair is currently trading near the apex of the falling wedge, which is a bullish pattern. Accordingly, the upside risks are increased, and if the upper trend-line at 8.3850 is breached, USD/NOK will be well-positioned for a 0.7-0.8% rise up to the resistance area between 8.44 and 8.46. There the weekly PP merges with the long-term moving average and July 13 highs. If this supply zone is crossed as well, the next objective will be the July 8 high at 8.55. Alternatively, in case the price closes below 8.3350, the rate will likely gravitate towards 8.2835, namely the July 4 low.

The US Dollar is set to increase in value against the Norwegian Krone. The currency pair is currently trading near the apex of the falling wedge, which is a bullish pattern. Accordingly, the upside risks are increased, and if the upper trend-line at 8.3850 is breached, USD/NOK will be well-positioned for a 0.7-0.8% rise up to the resistance area between 8.44 and 8.46. There the weekly PP merges with the long-term moving average and July 13 highs. If this supply zone is crossed as well, the next objective will be the July 8 high at 8.55. Alternatively, in case the price closes below 8.3350, the rate will likely gravitate towards 8.2835, namely the July 4 low.

Fri, 15 Jul 2016 07:14:33 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.