Note: This section contains information in English only.

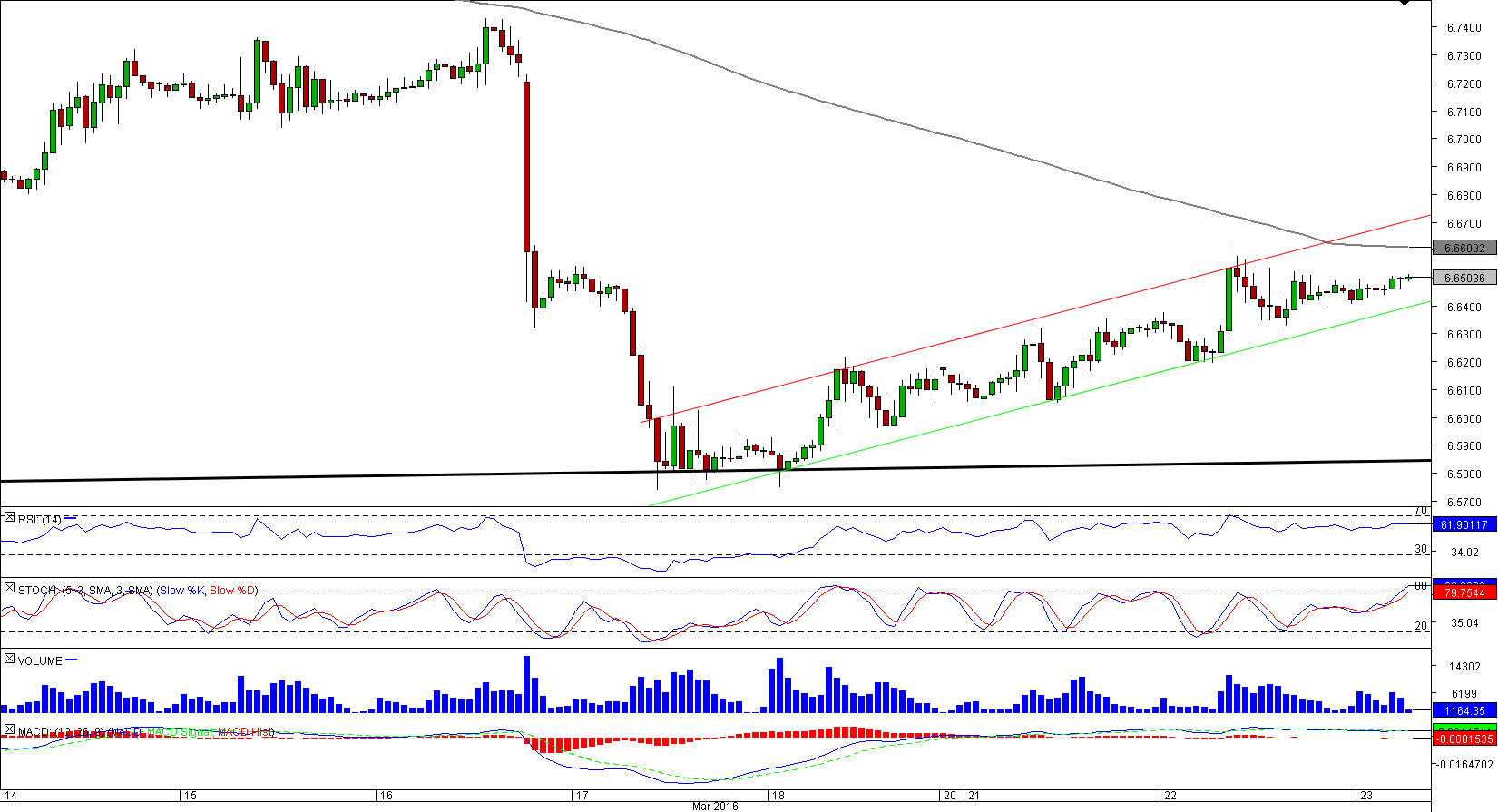

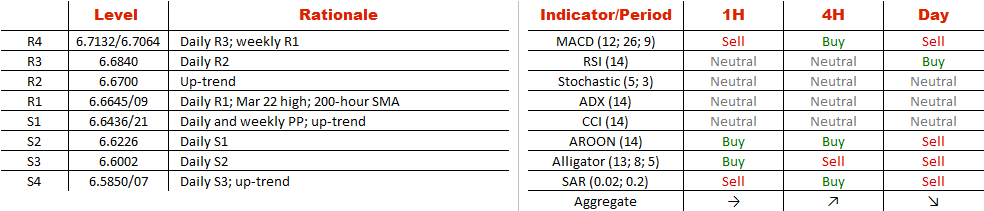

The US Dollar is expected to keep appreciating against the Danish Krone. USD/DKK has recently established a well-defined bullish channel after confirming a major support up-trend line at 6.58, meaning the near-term dips are to be limited by the weekly pivot point and the lower boundary of the pattern at 6.6436/21. At the same time, we should be wary of a strong resistance area at 6.6650/00, created by the daily R1, March 22 high and 200-hour SMA. If this obstacle is overcome, the pair is likely to steer for the weekly R1 at 6.7130 next. Alternatively, should the rate sink under 6.6436/21, the sell-off will presumably extend down to 6.5850. Meanwhile, the US Dollar is to some extent overbought, being that 63% of open positions are long.

The US Dollar is expected to keep appreciating against the Danish Krone. USD/DKK has recently established a well-defined bullish channel after confirming a major support up-trend line at 6.58, meaning the near-term dips are to be limited by the weekly pivot point and the lower boundary of the pattern at 6.6436/21. At the same time, we should be wary of a strong resistance area at 6.6650/00, created by the daily R1, March 22 high and 200-hour SMA. If this obstacle is overcome, the pair is likely to steer for the weekly R1 at 6.7130 next. Alternatively, should the rate sink under 6.6436/21, the sell-off will presumably extend down to 6.5850. Meanwhile, the US Dollar is to some extent overbought, being that 63% of open positions are long.

Wed, 23 Mar 2016 07:16:41 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.