Note: This section contains information in English only.

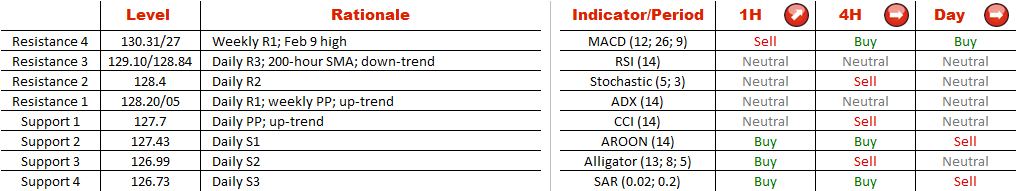

The bullish correction from 126 yen (2015 low) in the four-hour chart might have to wait. The currency pair is forming a rising wedge, a pattern that implies a sell-off. At the same time, EUR/JPY is approaching a dense supply area at 129, where the daily R3 coincides with the 200-hour moving average and the down-trend formed during the first week of February. Accordingly, we expect the Euro to revisit last year's minimum. As for the alternative scenario, the initial objective will be at 130.30 (weekly R1 and Feb 9 high), while sellers at 131.50 should still put a lid on the rally. Meanwhile, the SWFX market is moderately bullish, being that 57% of open positions are long.

The bullish correction from 126 yen (2015 low) in the four-hour chart might have to wait. The currency pair is forming a rising wedge, a pattern that implies a sell-off. At the same time, EUR/JPY is approaching a dense supply area at 129, where the daily R3 coincides with the 200-hour moving average and the down-trend formed during the first week of February. Accordingly, we expect the Euro to revisit last year's minimum. As for the alternative scenario, the initial objective will be at 130.30 (weekly R1 and Feb 9 high), while sellers at 131.50 should still put a lid on the rally. Meanwhile, the SWFX market is moderately bullish, being that 57% of open positions are long.

Tue, 16 Feb 2016 07:24:35 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.