Note: This section contains information in English only.

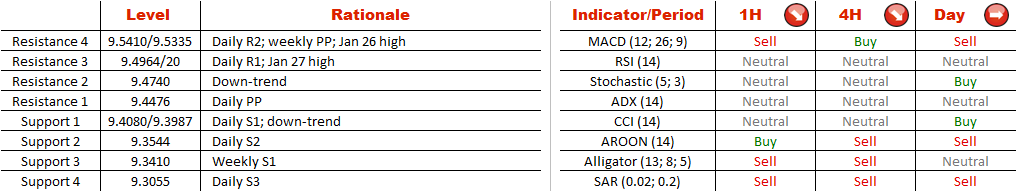

After EUR/NOK formed a rising wedge at the end of the previous week, the currency pair is now approaching the apex of the falling wedge. Accordingly, while the near-term bias is negative, which is also confirmed by the hourly and four-hour technical indicators, we should be wary of a potential reversal. The outlook will be changed to bullish once the price crosses the declining trend-line at 9.4740. The initial target in this case will be the supply area at 9.4964/20, but the rally will probably extend higher, up to 9.5409/9.5335, where the January 26 high is joined by the weekly pivot point. Alternatively, should the rate slip under 9.40, there is likely to be sell-off down to 9.34 (weekly S1).

After EUR/NOK formed a rising wedge at the end of the previous week, the currency pair is now approaching the apex of the falling wedge. Accordingly, while the near-term bias is negative, which is also confirmed by the hourly and four-hour technical indicators, we should be wary of a potential reversal. The outlook will be changed to bullish once the price crosses the declining trend-line at 9.4740. The initial target in this case will be the supply area at 9.4964/20, but the rally will probably extend higher, up to 9.5409/9.5335, where the January 26 high is joined by the weekly pivot point. Alternatively, should the rate slip under 9.40, there is likely to be sell-off down to 9.34 (weekly S1).

Thu, 28 Jan 2016 07:08:44 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.