Note: This section contains information in English only.

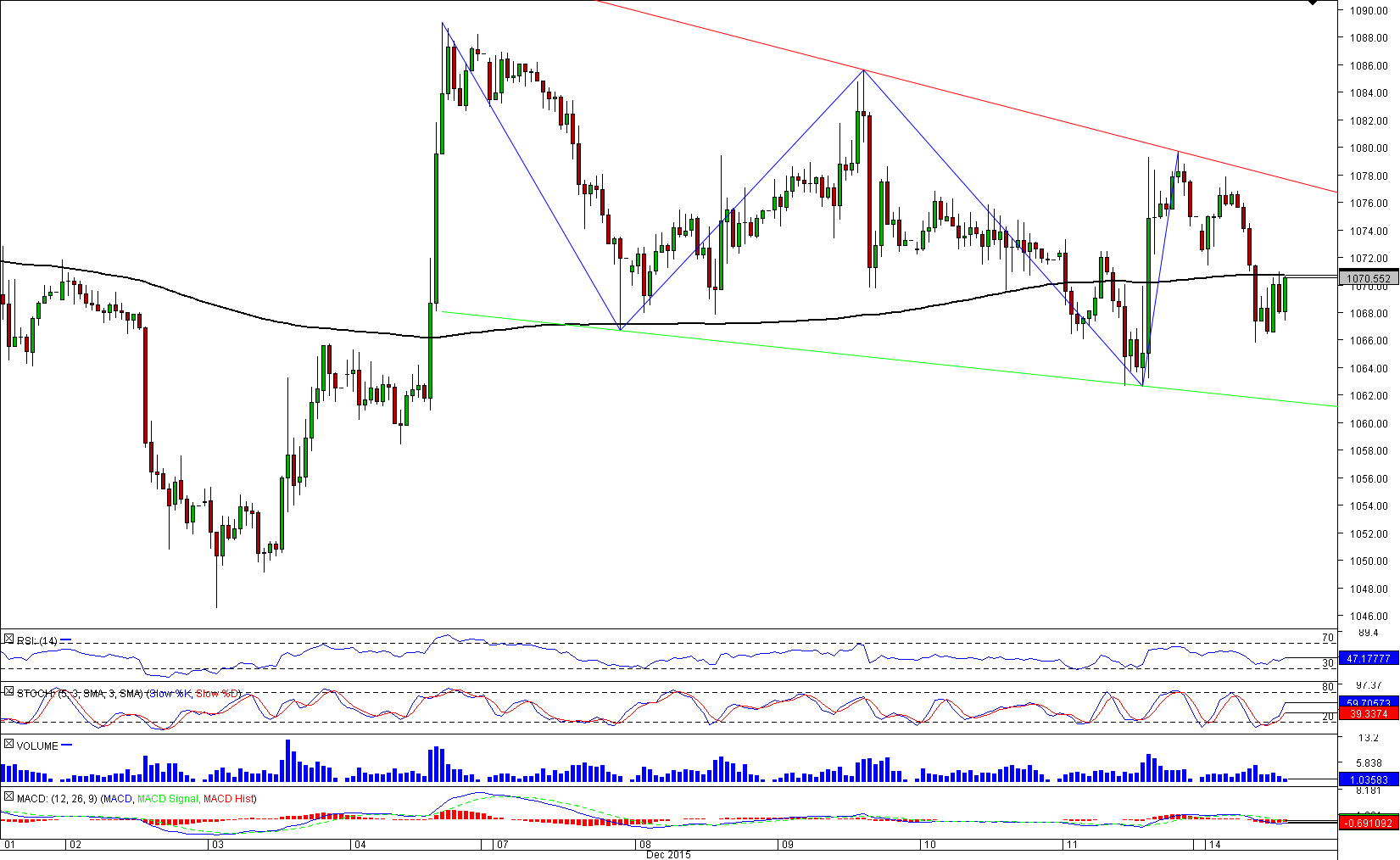

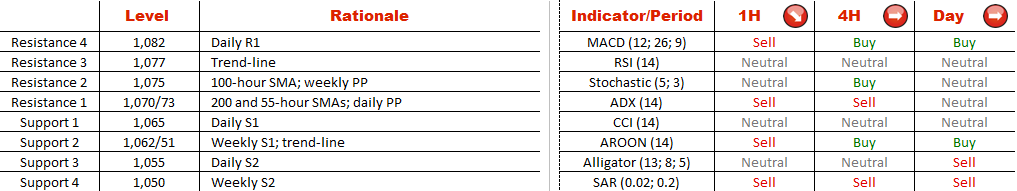

Gold has been ticking down on Monday, meaning that near term outlook is going to remain quite bearish. On Friday the local high has been touched at 1,079, as the cross fell short of reaching the Dec 9 high at 1,085. Now the main obstacle is represented by the 200-hour SMA at 1,070. There is a possibility of a bounce back in the direction of the weekly pivot point, but the presence of 100/55-hour SMAs is making the bullish scenario more complicated. On top of that, hourly technical indicators are pointing downwards and gold remains overbought in the SWFX market (62% long). We foresee an eventual drop towards 1,062 (monthly S1; trend-line), which will expose the current Dec low at 1,046.

Gold has been ticking down on Monday, meaning that near term outlook is going to remain quite bearish. On Friday the local high has been touched at 1,079, as the cross fell short of reaching the Dec 9 high at 1,085. Now the main obstacle is represented by the 200-hour SMA at 1,070. There is a possibility of a bounce back in the direction of the weekly pivot point, but the presence of 100/55-hour SMAs is making the bullish scenario more complicated. On top of that, hourly technical indicators are pointing downwards and gold remains overbought in the SWFX market (62% long). We foresee an eventual drop towards 1,062 (monthly S1; trend-line), which will expose the current Dec low at 1,046.

Mon, 14 Dec 2015 14:16:43 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.