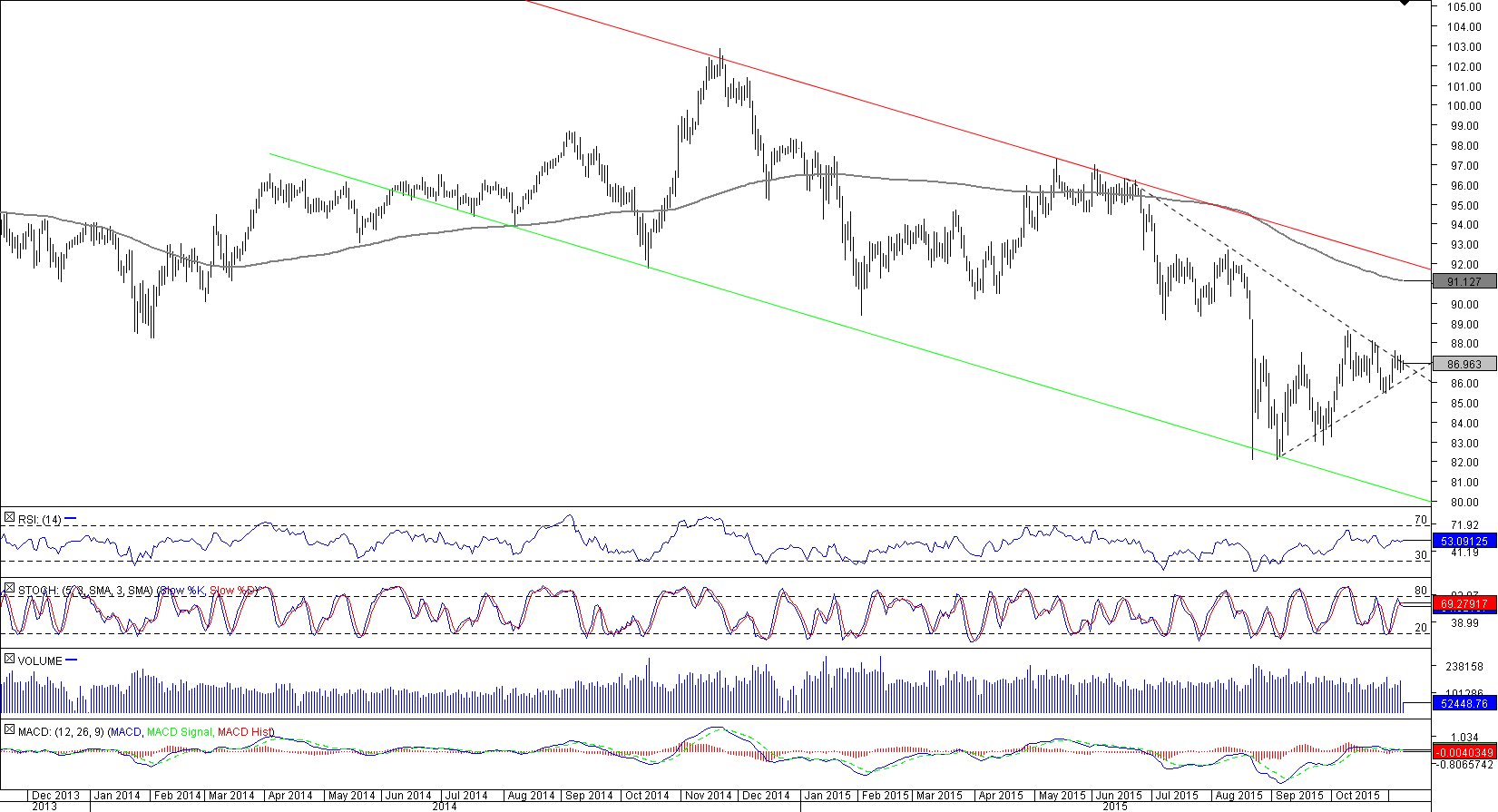

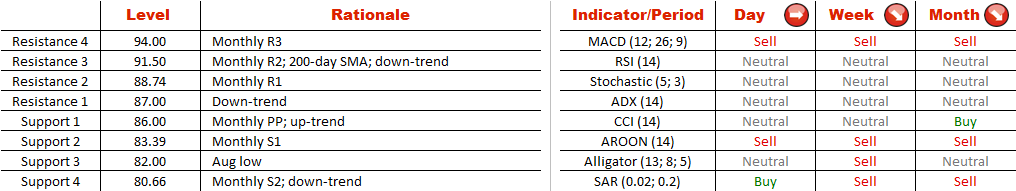

The immediate support is at 86, created by the recently established up-trend and monthly pivot point. Additional levels are at 83.39 and 82.00, while the key demand area is around 80.50, consisting of the down-trend and monthly S2.

Note: This section contains information in English only.

Despite the bearish bias implied by the weekly and monthly technical indicators we hold a bullish outlook on AUD/JPY in the medium term. The price is expected to extend recovery from 82 yen (August minimum) until it reaches the upper boundary of the pattern at 91.50, which in turn is reinforced by the monthly R2 and 200-day SMA. However, in case resistance is breached, this will expose the May high at 97.32.

Despite the bearish bias implied by the weekly and monthly technical indicators we hold a bullish outlook on AUD/JPY in the medium term. The price is expected to extend recovery from 82 yen (August minimum) until it reaches the upper boundary of the pattern at 91.50, which in turn is reinforced by the monthly R2 and 200-day SMA. However, in case resistance is breached, this will expose the May high at 97.32.

The immediate support is at 86, created by the recently established up-trend and monthly pivot point. Additional levels are at 83.39 and 82.00, while the key demand area is around 80.50, consisting of the down-trend and monthly S2.

Mon, 09 Nov 2015 08:24:10 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

The immediate support is at 86, created by the recently established up-trend and monthly pivot point. Additional levels are at 83.39 and 82.00, while the key demand area is around 80.50, consisting of the down-trend and monthly S2.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.