Note: This section contains information in English only.

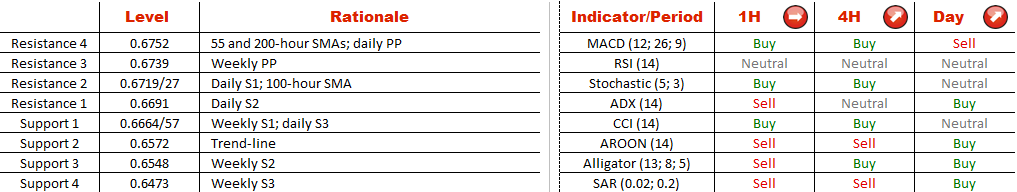

The Kiwi managed to escape a dense demand area at 0.6730/70, where the weekly pivot point and 100-hour SMA were among those levels that tried to prevent the current bearish trend. However, after crossing the daily S1 at 0.6719 the lead of bears is more pronounced. The weekly S1 and daily S3 are two next supports to be breached at 0.6664/57. In case bears push the price below them, this situation is highly likely to extend the sell-off beyond 0.66, in order to reach the pattern's lower boundary eventually. On the other hand, technical studies on four-hour and daily time-frames retain bullish views with respect to NZD/USD, meaning a recovery may start in course of the next 24 hours.

The Kiwi managed to escape a dense demand area at 0.6730/70, where the weekly pivot point and 100-hour SMA were among those levels that tried to prevent the current bearish trend. However, after crossing the daily S1 at 0.6719 the lead of bears is more pronounced. The weekly S1 and daily S3 are two next supports to be breached at 0.6664/57. In case bears push the price below them, this situation is highly likely to extend the sell-off beyond 0.66, in order to reach the pattern's lower boundary eventually. On the other hand, technical studies on four-hour and daily time-frames retain bullish views with respect to NZD/USD, meaning a recovery may start in course of the next 24 hours.

Tue, 03 Nov 2015 14:25:04 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

Aby dowiedzieć się więcej o Opcjach Binarnych w Banku Dukascopy / platformach handlowych Forex, SWFX, oraz innych,

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

zadzwoń do nas lub pozostaw prośbę o oddzwonienie.

Aby dowiedzieć się więcej o handlu Forex/CFD na platformie Dukascopy Banku, rynku SWFX oraz innych rzeczy związanych z handlem,

zadzwoń do nas lub poproś o oddzwonienie.

zadzwoń do nas lub poproś o oddzwonienie.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.